A Buyer's Guide to P&C Case Management Solutions

Jan 17, 2026

Discover the best case management solutions for P&C claims. This guide covers key features, evaluation criteria, ROI, and implementation best practices.

Ever tried to solve a complex puzzle with the pieces scattered across different rooms? Some are buried in email chains, others are stuck in siloed software, and a few are just scribbled on a notepad. For too long, this has been the reality of handling P&C claims.

Now, imagine a modern command center. Every single piece of that puzzle—photos, legal notices, policy documents, expert reports—is organized and instantly accessible on one screen. That’s the fundamental power of a case management solution.

These platforms are much more than digital filing cabinets. They are intelligent systems designed to bring order to the inherent chaos of the claims process. They act as the single source of truth for carriers, third-party administrators (TPAs), and legal teams, turning fragmented data into clear, actionable intelligence. In an industry where efficiency is directly tied to profitability and customer loyalty, this isn't just a nice-to-have; it's essential.

From Manual Maze to Modern Command Center

The leap from manual, paper-shuffling workflows to integrated digital platforms is a massive turning point for the industry. Adjusters who once burned hours on administrative drag—tedious data entry, hunting for documents—can now pour that energy into high-value work like investigation, negotiation, and settlement strategy.

This transformation is happening for a reason. The global market for case management software hit USD 8.26 billion in 2024 and is expected to rocket to USD 24.09 billion by 2034. That explosive growth is fueled by an urgent need to automate complex workflows not just in insurance, but across legal and healthcare too. You can explore more data on the case management software market to see just how fast things are moving.

Here's a quick comparison showing the evolution from manual, siloed processes to the integrated, intelligent command center that modern case management provides.

Process Step | The Old Way (The Maze) | The New Way (The Command Center) |

|---|---|---|

Claim Intake | Manual sorting of emails, faxes, and uploads. Data entry is slow and error-prone. | Automated ingestion from any source. Data is extracted and categorized instantly. |

Document Org | Files are stored in multiple systems: email, local drives, physical folders. | All documents are centralized in a single, unified case file. Searchable and secure. |

Team Collab | Updates are shared via email chains and phone calls. Version control is a nightmare. | All stakeholders view the same real-time information. Notes and tasks are shared in-platform. |

Status Tracking | Relies on manual logs or spreadsheets. Often outdated and inconsistent. | A live dashboard provides a clear, consistent view of every claim's status and next steps. |

Reporting | Compiling reports is a manual, time-consuming task pulling from different sources. | Automated, audit-ready reports are generated in seconds with full data integrity. |

This table highlights a fundamental shift in operations. The goal isn't just to digitize old habits; it's to create a smarter, more resilient claims handling process from the ground up.

Modern solutions get to the heart of old P&C challenges by:

Centralizing Information: Ingesting documents from any source—email, web portals, direct uploads—into one unified workspace.

Automating Intake: Getting rid of the mind-numbing, error-prone process of manually sorting and categorizing incoming claim files.

Providing a Unified View: Offering a single, consistent perspective on every claim, so everyone involved is on the same page.

At its core, a case management solution turns reactive, administrative work into a proactive, strategic process. It equips teams with the tools to manage complexity, slash claim cycle times, and deliver consistent, audit-ready outcomes.

By building this structured foundation, these systems clear the way for more advanced capabilities like AI-powered triage and automated risk assessment—which we’ll get into next.

Essential Features of Modern Claims Platforms

To really get what a top-tier case management solution can do, you have to look past a simple checklist. The platforms that truly move the needle are built on a core set of non-negotiable features. These aren’t just add-ons; they're the engine that turns the chaos of a claim file into something clear and manageable.

Think of it like this: a shared drive can hold your documents, but an intelligent platform actively manages them. It knows what a document is, understands its role in the claim, and nudges you when something important is missing. That’s the difference between a digital filing cabinet and a true strategic tool.

Let's break down the essential features that make this happen.

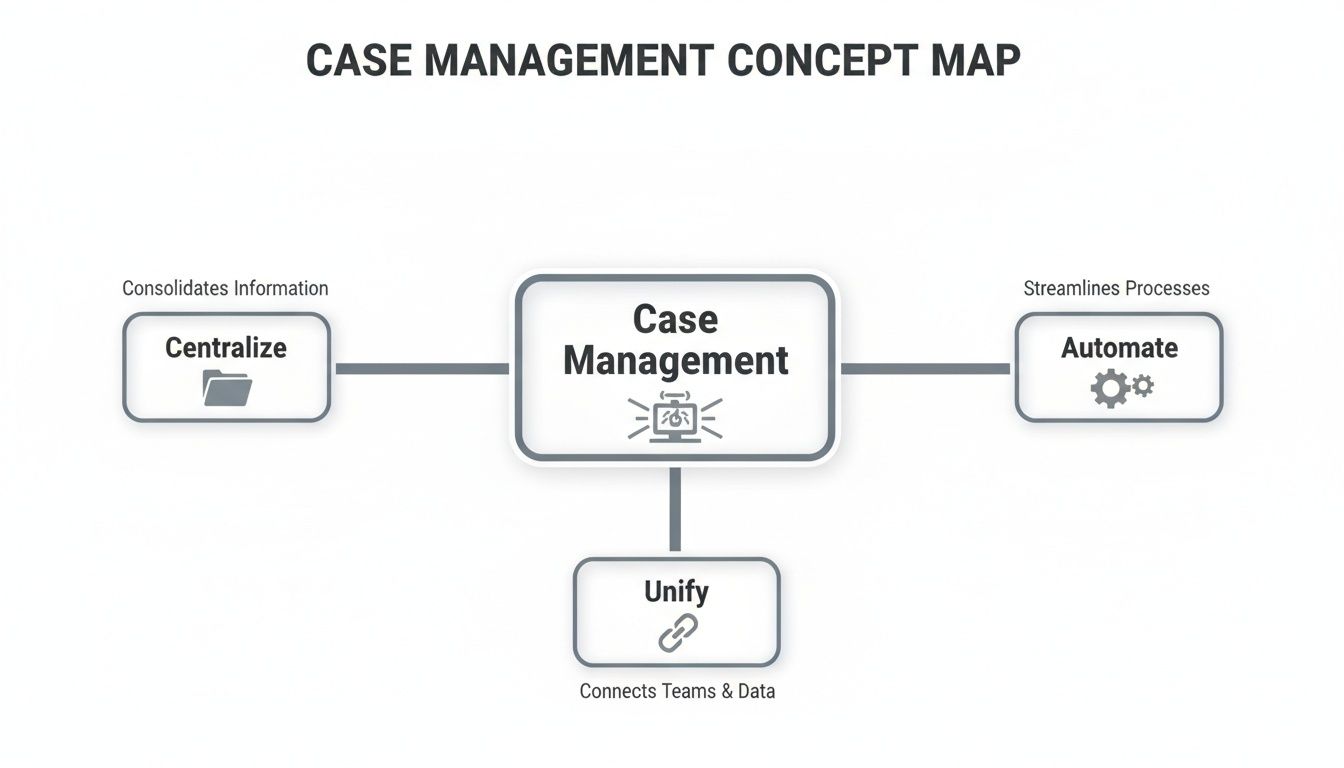

This visual shows how modern case management solutions centralize information, automate key processes, and unify teams.

The key takeaway here is that these three pillars—centralization, automation, and unification—aren't separate ideas. They're deeply connected and form the foundation for a more efficient and reliable claims operation.

Centralized Intake and Unification

The starting point for any effective system is a centralized intake hub. This is much more than a digital dumping ground. It's an intelligent workspace that automatically pulls in claim-related documents from any source—an email, a portal upload, or a direct scan. Everything lands in one place, creating a single source of truth for every claim.

Right away, this kills the soul-crushing, error-prone task of manually chasing down and organizing files. No more digging through three different inboxes to find that one crucial police report.

For example, on a complex liability claim, documents might trickle in from a dozen different parties over weeks. A centralized system automatically grabs every email, photo, and legal notice, filing it into the correct case file without an adjuster having to lift a finger.

AI-Powered Triage and Categorization

Once all the information is in one place, the next vital feature kicks in: AI-powered triage. This is like having an expert paralegal or a senior adjuster on staff who can instantly review, identify, and categorize every piece of incoming evidence. It knows the difference between a legal summons, a medical invoice, and a property damage estimate—and it works with incredible speed.

This kind of automation is a game-changer. Adjusters can spend up to 67% of their day on administrative tasks that don't move the claim forward. AI triage attacks that waste head-on, freeing up your best people to focus on analysis and strategy.

An advanced platform doesn’t just store a PDF; it understands it. It reads the document, pulls out key data, and tags it for relevance. It turns a mountain of raw data into a structured, searchable evidence library in minutes.

Risk Intelligence and Gap Detection

The most advanced platforms don't just organize information; they provide intelligence. Two features are critical here:

Risk Intelligence Scoring: This gives you an immediate, data-driven gut check on a claim's potential severity. By analyzing the initial documents, the system can flag high-risk cases that need a senior adjuster's eyes from day one.

Proactive Gap Detection: This is where the system gets really smart. It actively tracks required documents against what you've actually received. If a necessary form is missing, the system flags the gap, preventing a bottleneck before it can stall the entire claim.

For instance, the system might know that a certain type of water damage claim always requires an engineering report. If that report hasn't been submitted by a certain point, it will alert the adjuster, ensuring the file stays complete and compliant.

Of course, having great features is only half the battle. You need strong operational habits to make the most of them. For a deeper look, check out our guide on 10 property and casualty claims case management best practices for 2025.

When you put these features together, you empower adjusters to stop being reactive administrators and start being proactive strategists. That shift doesn't just improve efficiency—it directly impacts claim outcomes and your bottom line.

Picking the Right Platform: A Buyer's Checklist

Choosing a case management platform isn't just another software purchase. It's a fundamental business decision that will reshape how your entire claims operation runs. To cut through the noise and make a smart choice, you need a practical way to evaluate your options. This buyer’s checklist is built around four pillars that separate a simple tool from a genuine strategic partner.

By focusing on these areas, you can look past the glossy feature lists and get a real sense of how a solution will perform in the trenches of P&C claims. It's about finding a platform that’s secure, connected, intelligent, and transparent.

The market for case management solutions is booming for a good reason. In 2024, the global market was valued at USD 11.0 billion and is on track to hit USD 19.7 billion by 2030. That growth is fueled by an urgent need for better analytics, smarter workflows, and deep system integrations—especially for P&C carriers and TPAs drowning in high claim volumes. Discover more insights about the growing case management market on marketresearch.com.

Pillar 1: Security and Compliance

When you're handling sensitive claims data, security is non-negotiable. A data breach doesn’t just tarnish your reputation; it opens the door to massive legal and financial liability. Your evaluation has to start with a serious look at a vendor's security posture.

Here’s what you absolutely need to verify:

SOC 2 Certification: This is the gold standard for data security. A SOC 2 report isn't just a piece of paper; it’s an independent, third-party audit confirming the vendor has tough controls in place to protect your data. Always ask for their latest report.

HIPAA Readiness: If any of your claims involve protected health information (PHI), the platform must be fully HIPAA-ready. There's no middle ground here.

Data Encryption: Make sure data is encrypted both in transit (as it moves across the internet) and at rest (when it's stored on their servers). This is basic, fundamental security hygiene.

Think of security certifications not as a feature, but as a third-party guarantee. They prove a vendor is committed to protecting your most valuable asset—your data—and has the audited processes to back it up.

Pillar 2: Seamless Integration Capabilities

A case management solution that can't talk to your other systems is worse than useless—it’s a liability. It becomes another data silo, forcing your adjusters into the soul-crushing cycle of copying and pasting information between windows. The real value is unlocked when everything connects seamlessly.

The single most critical integration is with your core Claims Management System (CMS). This connection has to be rock-solid, ensuring there's a single, undisputed source of truth for every claim. A robust API (Application Programming Interface) is the key, allowing your systems to talk to each other automatically without any human babysitting.

Pillar 3: AI and Automation Maturity

Let's be honest: not all "AI" is created equal. Plenty of platforms bolt on generic AI features that sound impressive but fall flat in the real world. For P&C claims, you need domain-trained intelligence. This means the AI has been specifically taught to understand the unique language and context of insurance and legal documents.

Here's how you can tell a mature AI from a pretender:

Ask for Specifics: Don’t let them get away with vague "AI-powered" promises. Ask pointed questions. "Show me how your AI can tell the difference between a police report and a medical invoice during intake."

Test the Triage: How accurately can the system categorize and tag documents without a human stepping in? A mature AI should handle the heavy lifting here, freeing up your team for judgment-based work.

Look for Proactive Intelligence: Does the AI just sort data, or does it actually provide insight? Look for things like proactive gap detection, where the system flags missing documents before they can cause a delay.

Pillar 4: Robust Auditability and Reporting

In the tightly regulated world of insurance, you have to be able to prove everything. Every action, every decision, every document upload needs to be traceable. A strong case management solution creates a complete, unchangeable audit trail for every single claim file. This becomes your bulletproof record during litigation, compliance reviews, or internal audits.

When you're vetting vendors, confirm the platform can generate reports on key metrics, user activity, and claim status on the fly. This transparency is crucial for managing your team's performance, spotting bottlenecks, and ensuring you get consistent, defensible outcomes across your entire operation. It turns every case file into a clear, reliable story.

Measuring the ROI of Your Case Management Investment

Let’s get straight to the point. Adopting a new platform is a big decision, and the real question is always about the return on investment. What’s in it for you? With a case management solution, the payoff isn't just about software doing things faster; it's about fundamentally improving the core metrics that drive your business. To build a solid business case, you have to move beyond fuzzy benefits and focus on the data.

This isn’t just a niche trend. The market for these platforms was valued at USD 7.53 billion in 2024 and is on track to hit USD 17.38 billion by 2032. Why the explosive growth? Because for restoration companies, attorneys, and insurers, a centralized, intelligent platform is proving to slash resolution times and catch information gaps before they turn into expensive headaches. You can learn more about the explosive growth of the case management market to see where the industry is heading.

So, how do you actually measure this value? It comes down to tracking the right key performance indicators (KPIs) that smart technology is designed to move.

Quantifying the Hard ROI with Key Metrics

Hard ROI is the stuff that shows up on the balance sheet—the dollars and days you get back. These are the concrete, no-fluff gains that justify the investment. Three metrics tell most of the story.

Claim Resolution Time (Cycle Time): This is the clock running from the First Notice of Loss (FNOL) all the way to settlement. Manual processes are notorious for administrative black holes, like chasing down documents or waiting on approvals. Automation blows through those delays. We’ve seen organizations resolve claims up to four times faster.

Cost-Per-Claim: Think of this as the all-in price tag for handling a single claim—labor, overhead, vendor fees, the works. By automating intake, triage, and document wrangling, a modern solution drastically cuts the manual hours poured into each file, delivering serious operational savings.

Adjuster Productivity: How many claims can one adjuster realistically manage without dropping the ball? When you take the low-value administrative grind off their plate, they can handle a much higher caseload. This allows you to scale your operations without having to scale your headcount at the same rate.

The real goal here isn't just to work faster, but to work smarter. When you consider that 60-70% of an adjuster's day can be eaten up by administrative tasks, automating that work unlocks their most valuable skills: investigation, negotiation, and strategic decision-making.

The Overlooked Value of Soft ROI

While the hard numbers get the initial buy-in, the “soft ROI” is what creates a healthier, more resilient organization in the long run. These benefits might be tougher to stick in a spreadsheet, but their impact is undeniable.

One of the biggest wins is in employee morale and retention. Claims professionals are experts, yet they’re often stuck doing tedious, repetitive work that leads to burnout. Free them up to focus on the high-value, strategic parts of their job, and you’ll see satisfaction and retention rates climb. That’s a massive advantage when talent is hard to find. For more on this, check out our guide on automating insurance claims processing to cut costs and improve workflows.

Another huge factor is data consistency and auditability. An intelligent platform tracks every touchpoint, creating a bulletproof record for any audit or litigation that comes your way. This improved risk posture isn't just a compliance checkbox; it’s peace of mind.

By combining these hard and soft metrics, you can build a complete picture of the value a modern case management solution truly delivers.

To put this into perspective, let's look at how modern solutions move the needle on the most critical KPIs.

Key Performance Metrics and Their Business Impact

This table summarizes how a modern, AI-powered solution can dramatically improve key metrics compared to traditional, manual workflows.

Metric | Traditional Benchmark | Potential Improvement with AI | Business Impact |

|---|---|---|---|

Claim Cycle Time | 30-45 days | < 15 days | Faster settlements, improved cash flow, and significantly better customer satisfaction. |

Cost-Per-Claim | $600 - $900 | 25-40% Reduction | Lower loss adjustment expenses (LAE) and increased operational profitability. |

Adjuster Caseload | 100-150 active claims | Up to 250+ claims | Ability to scale operations without a proportional increase in headcount; higher productivity. |

Compliance Risk | Moderate to High | < 1% Error Rate | Reduced risk of fines, penalties, and litigation due to consistent, auditable processes. |

As the numbers show, the impact goes far beyond simple efficiency. It's about building a more profitable, scalable, and defensible claims operation from the ground up.

A Practical Roadmap for a Successful Rollout

Bringing a powerful new case management solution into your operation is far more than a technical upgrade—it’s a fundamental shift in how your team gets work done. Success hangs less on the technology itself and more on a smart, thoughtful implementation strategy. A rushed, top-down rollout is a recipe for user resistance and missed opportunities. The key is to approach it as a change management challenge from day one.

A successful implementation isn't about flipping a switch and hoping for the best. It's about building momentum, proving value quickly, and getting everyone on board because they want to be. This roadmap offers a practical, step-by-step approach to make sure your investment pays off right away.

Start with a Focused Pilot Program

Instead of a risky, company-wide launch, the smartest play is to start with a targeted pilot program. This lets you rack up some clear wins in a controlled environment, creating internal champions who can vouch for the new system. A pilot minimizes risk and gives you the space to refine your process before you scale.

Think of it as a strategic first move. Pick a specific area where you can achieve a quick, measurable victory. Good candidates for a pilot often include:

A Specific Claim Type: Focus on a high-volume or notoriously tricky area, like subrogation claims or catastrophic (CAT) event files.

A Single Team or Pod: Roll out the solution to one dedicated team of adjusters and benchmark their performance against a control group. The data will speak for itself.

A Known Pain Point: Target a workflow famous for bottlenecks, like initial claim intake and triage, to show an immediate, tangible impact on efficiency.

By starting small, you prove the concept, iron out any wrinkles, and build a powerful, data-backed case for a broader rollout. Success in the pilot phase becomes undeniable proof that the change is worth making.

Define Your Ideal Workflows Before You Configure Anything

A common pitfall is trying to cram your old, often inefficient, workflows into a new tool. That's backward. The implementation process is the perfect chance to rethink and optimize how work actually gets done. Before you touch a single setting, map out your ideal state.

Ask the tough questions: Where are the delays right now? What steps are redundant? How can automation get rid of the low-value tasks that drain our adjusters' time? By defining these clean, optimized workflows first, you ensure the technology is configured to solve your actual business problems, not just digitize bad habits.

Train for the "Why," Not Just the "How"

This is the final, crucial piece of the puzzle. Most software training focuses on the "how"—click this button, fill out that field. While that's necessary, it completely misses the most important part: the "why."

Your team needs to understand how this new case management solution makes their job easier, more strategic, and less of a headache. Frame the training around benefits, not just features.

Show, Don't Just Tell: Use real-world claim scenarios to demonstrate how the platform eliminates tedious work they hate doing.

Highlight Personal Wins: Explain how automated triage frees them up to focus on investigation and negotiation—the parts of the job where their expertise truly shines.

Create "Super Users": Identify a few enthusiastic team members to become internal experts and advocates. They can provide invaluable peer-to-peer support that feels more genuine than a top-down mandate.

When adjusters see the platform as a tool that empowers them rather than another system they're forced to use, adoption becomes a natural, even enthusiastic, process. This user-first approach ensures your roadmap leads to real, sustained success.

The Future of AI-Driven Claims Intelligence

The claims industry is at a major turning point. For years, case management solutions were all about organizing the past—a digital filing cabinet for centralizing documents and tracking what already happened.

But the future isn't about looking in the rearview mirror. It’s about actively shaping the outcome of a claim. The conversation has shifted from reactive record-keeping to proactive, AI-powered decision support.

This isn't some far-off vision; it's the new reality taking shape today. The most forward-thinking platforms are embedding domain-trained intelligence directly into the claims workflow. This means you have an AI that actually understands the specific language of insurance policies, legal notices, and medical reports. It’s a specialized partner, not a generic, off-the-shelf tool.

This evolution is unlocking next-generation capabilities that fundamentally change an adjuster's day-to-day work.

From Administrator to Strategist

Imagine an adjuster who spends their day on high-value tasks—strategic analysis, complex negotiations, and empathetic customer communication. This is what AI-driven claims intelligence makes possible. Instead of manually sifting through a chaotic inbox, the system does the heavy lifting.

The goal is to elevate claims professionals by automating the administrative burden that bogs them down. When the system handles the tedious work, adjusters are free to apply their expertise where it matters most, leading to better, faster, and more consistent outcomes.

This transformation is powered by specific, in-platform tools that act as intelligent assistants:

AI-Powered Companions: Think of an expert paralegal sitting beside every adjuster, ready to summarize a 100-page deposition in seconds or find a critical piece of evidence buried in thousands of documents.

Automated Document Drafting: The system can generate routine correspondence, settlement letters, or status updates based on case data, ensuring accuracy and freeing up valuable time.

Predictive Insights: By analyzing historical data, the AI can flag potential risks or suggest optimal settlement ranges, providing data-driven support for critical decisions.

Building a Foundation for Tomorrow

Investing in the right case management solution today is the essential first step toward this intelligent future. A platform built on a strong foundation of centralized data and automated workflows is the launchpad for these advanced AI capabilities. Let’s be clear: without a clean, structured data environment, AI simply can't deliver meaningful insights.

You can learn more by exploring the latest 2025 trends in claims management and automation.

Choosing a solution with a clear AI roadmap means you aren't just buying a tool for today; you're investing in a platform that will grow with your team. It’s about building a more efficient, accurate, and scalable claims operation prepared for whatever comes next.

Got Questions? We've Got Answers.

When you're looking at bringing in a new technology partner, the questions start flying. And they should—it’s a big decision. We've been in these conversations countless times, so we’ve pulled together the most common questions leaders ask when they're evaluating a modern case management solution.

How Long Does It Take to Get a New Solution Up and Running?

This isn't your old-school, on-premise software that takes a year to install. Modern cloud platforms are built for speed. A standard setup for a smaller team can be up and running in just a few weeks.

Of course, if you're a large enterprise with a web of complex legacy systems to connect, the timeline might stretch to a few months. A smart way to start is with a focused pilot program. This gets the tool into your team's hands quickly, proves the value right away, and builds momentum for the full, phased rollout.

Can This Integrate With Our Current Claims System?

Absolutely. In fact, if a solution can't do this, you should walk away. Seamless integration is a non-negotiable feature for any top-tier case management platform. The best ones are built with powerful APIs (Application Programming Interfaces) designed to talk to your other critical business systems.

The most important handshake is with your main Claims Management System (CMS) or legal billing software. A solid integration creates a smooth, automatic flow of data between systems. This kills off redundant data entry and gives you a single, reliable source of truth for every claim.

How Secure Is Our Claims Data on a Cloud Platform?

Data security is everything, and any vendor worth their salt treats it as their absolute top priority. Reputable platforms invest millions in enterprise-grade security infrastructure and bring in independent auditors to put their controls to the test.

When you're vetting vendors, ask for their security credentials. Look for certifications like SOC 2, which is an independent stamp of approval confirming their security, availability, and confidentiality practices have been rigorously audited. If you handle personal health information, HIPAA readiness is a must-have. These aren't just acronyms; they're proof your data is protected.

How Much Training Will My Adjusters Need?

The goal of modern software isn't to force your team into a confusing new process. It's designed to feel intuitive and fit right into an adjuster's natural workflow. The best platforms are built with a clean, user-friendly experience to keep the learning curve short.

While there’s always some training to get comfortable with the more advanced features, it’s usually quick and can be knocked out in a few short sessions. The best vendors provide hands-on onboarding, clear training guides, and ongoing support to make sure your team feels confident from day one. That focus on ease-of-use is what drives adoption and ensures you actually get the full value out of your investment.

Ready to trade claims chaos for clear, audit-ready decisions? See how Wamy uses AI-driven intelligence to centralize intake, automate triage, and slash claim resolution times.

© 2025 Wamy. All rights reserved.