Automating Insurance Claims Processing A Guide to Cutting Costs

Jan 8, 2026

Discover how automating insurance claims processing reduces costs and speeds up payouts. This guide offers practical steps for boosting efficiency and accuracy.

When we talk about automating insurance claims, we're really talking about swapping out slow, manual workflows for a smart, digital system powered by technology like AI. Think of it as replacing clogged city streets with a superhighway. Claims can now move from intake to resolution in hours or days, not weeks, because we've eliminated the traffic jams caused by paperwork and human error. This approach doesn't just speed things up—it slashes costs and dramatically improves both accuracy and customer satisfaction.

Moving Beyond Manual Claims Processing

For decades, the insurance industry has been buried under towering stacks of paper, manual data entry, and endless administrative cycles. This old-school way of doing things isn't just slow; it's a massive operational drain. It creates bottlenecks that delay settlements, frustrate policyholders, and send costs soaring. Every single claim file is a journey filled with potential pitfalls, from a misread form to an overlooked piece of critical evidence.

The fallout from this inefficiency is crystal clear and easy to measure:

Operational Delays: Adjusters end up spending more time shuffling paper than actually making decisions.

Increased Costs: Sky-high labor expenses and "claims leakage"—paying out more than necessary—chew away at profit margins.

Inconsistent Outcomes: Two different adjusters might look at the same information and come to completely different conclusions, leading to unpredictable results.

Poor Customer Experience: Nothing drives away customers faster than a slow, frustrating claims process.

The Shift to Intelligent Automation

This guide isn't here to dwell on old problems. We're focused on a practical, modern alternative. Automating insurance claims is about so much more than just scanning paperwork. It's about building an intelligent workflow that turns raw, unstructured data into confident, audit-ready decisions. Imagine it as a specialized digital assistant that handles all the repetitive, low-value work with superhuman speed and precision.

This shift empowers your team to graduate from being data processors to becoming strategic decision-makers, focusing their expertise on the complex cases that truly demand a human touch.

A Clear Path to Efficiency

In the property and casualty world, this transformation has already delivered incredible results. While traditional auto and property claims can drag on for over 22 days, leading insurers using AI are hitting straight-through processing rates of 66-80% for simpler claims.

Platforms like Wamy push this even further, collecting claim documents up to 77% faster and resolving claims up to four times quicker—all without needing to hire more people. You can dig into more claims efficiency metrics to see the full impact.

This guide will lay out a clear roadmap to help you navigate this change, from understanding the core AI technologies to implementing a system that delivers real, measurable results. We’ll walk through how to build a resilient, efficient, and modern claims operation, one step at a time.

How AI Powers Modern Claims Automation

Automating insurance claims isn't about some single piece of "magic" software. It’s more like a highly efficient pit crew, where a team of specialized AI technologies work together, each with a very specific job. Once you understand these core components, you can demystify how a messy, raw claim file becomes a structured, decision-ready case in minutes.

Let's break down the key players in this tech ensemble. Think of them less as abstract concepts and more as digital specialists you’ve hired to perfect your claims workflow.

The Digital Speed Reader: Optical Character Recognition

The first hurdle in any claim is turning mountains of paperwork—scanned forms, PDFs, invoices—into usable digital text. This is where Optical Character Recognition (OCR) steps in. Imagine OCR as a digital speed-reader that scans a document and instantly transcribes every word and number into a format a computer can actually understand.

This is far more than just turning a picture of text into a text file. Modern OCR can identify the type of document, recognize handwriting, and pull out specific data points like a policy number or date of loss. It’s the foundational step that digitizes the raw material of every claim.

The Language Expert: Natural Language Processing

Once the text is digitized, Natural Language Processing (NLP) takes over. If OCR is the reader, NLP is the interpreter. It’s the “language expert” on the team that understands the meaning and context behind all those words.

NLP can read an adjuster's notes, a claimant's email, or a witness statement and pull out the critical information. For example, it can spot phrases describing the severity of an incident or pinpoint statements of liability. In short, it turns unstructured, conversational text into structured data points the system can analyze.

By understanding intent and context, NLP makes sure no critical detail gets lost in translation. It finds the signal in the noise of lengthy documents—a task that could easily take a human adjuster hours to complete.

The Specialist’s Eye: Domain-Trained Computer Vision

For property and casualty claims, photos and videos are indispensable pieces of evidence. This is where domain-trained computer vision acts as a specialist’s eye, trained specifically to analyze images for insurance-related details. This is worlds away from generic image recognition you might find on your phone.

This technology can:

Identify specific types of damage: It can tell the difference between hail damage on a roof and simple wear and tear.

Detect pre-existing conditions: The AI can spot rust or rot that was there long before the claimed event occurred.

Flag inconsistencies: It can recognize if an image's metadata doesn't match the location or time of the reported incident.

By providing an instant, expert analysis of visual evidence, computer vision gives adjusters a massive head start in validating the claim.

The Project Manager and The Digital Notary

All these powerful technologies need to work in perfect harmony. A workflow orchestrator serves as the project manager, making sure every task is completed in the right sequence. It routes digitized documents to the NLP engine, sends photos to the computer vision model, and flags the case for human review exactly when needed.

At the same time, an immutable audit trail acts as a digital notary. Every single action—from the initial document upload to the final decision—is recorded, timestamped, and secured. This creates a transparent, unchangeable record of the entire claims journey, which is absolutely essential for compliance and resolving disputes. These systems work together to provide smarter claims triage and better decision support. You can learn more about this in our guide on AI-powered decision support in claims triage.

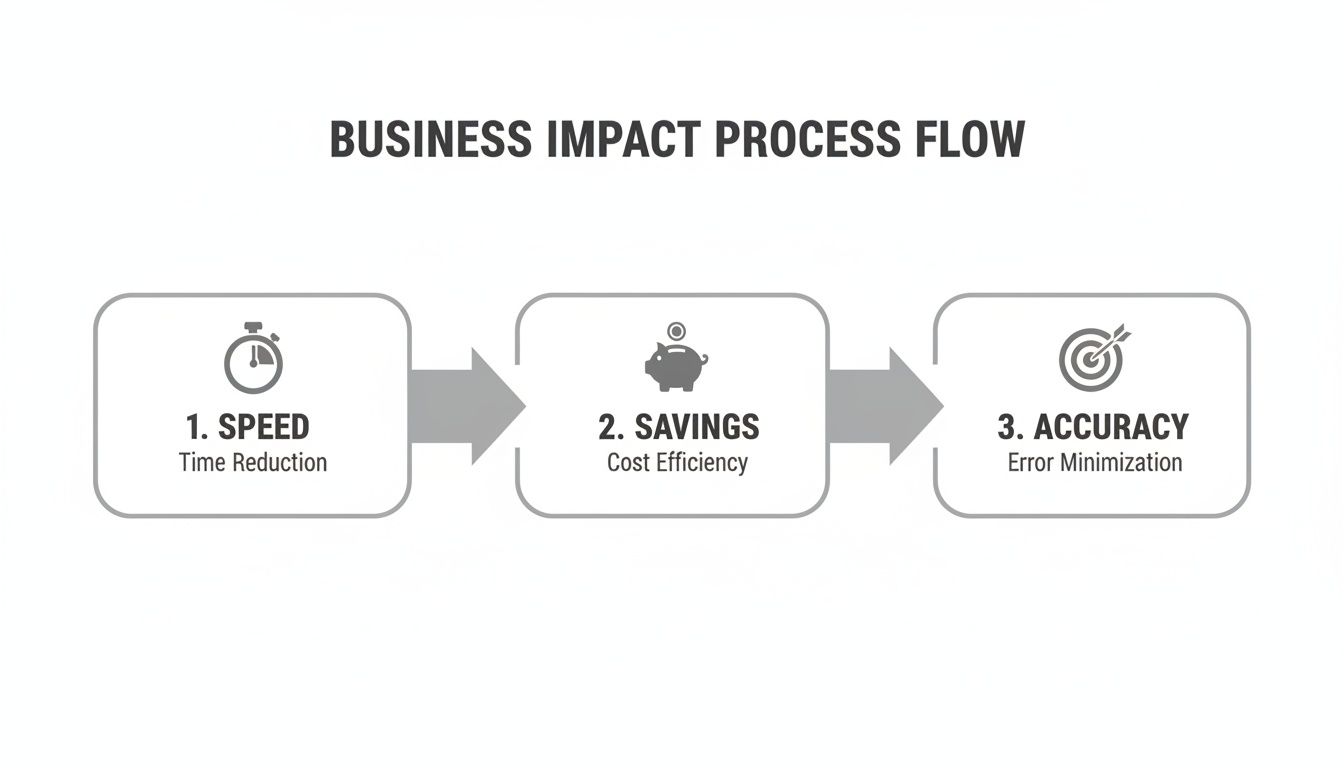

The Business Impact of Automating Claims

Understanding the tech is one thing, but seeing what it does for your business is where things get interesting. Bringing automation into your claims process isn't just an IT project; it’s a core business move that pays dividends across four critical areas: speed, cost savings, accuracy, and compliance.

These benefits don’t happen in a vacuum. They create a ripple effect that strengthens everything from your customer loyalty to your bottom line. Let's break down how this shift actually works and what it means for your operations.

Supercharge Your Speed and Customer Satisfaction

In the insurance world, speed is the new currency for customer satisfaction. Nothing sours a policyholder relationship faster than a claim that drags on forever. Automation tackles this problem head-on by hitting the accelerator on the entire claims lifecycle, from the first notice of loss right through to the final payout.

Instead of waiting days for a human to review a stack of documents, an AI-powered system can ingest, sort, and analyze an entire claim file in minutes. This means simple, low-complexity claims can fly through with straight-through processing, often getting resolved in hours instead of weeks. For the more complicated cases, automation gives your adjusters a complete, structured file right away, so they can jump into the critical thinking part of their job without any delay.

This newfound velocity isn't just about hitting internal targets; it’s about transforming the customer experience. A faster, more transparent process creates happier policyholders, drives up retention rates, and builds a rock-solid brand reputation in a crowded market.

Unlock Significant Cost Reductions

The financial argument for automation is impossible to ignore. Manual claims handling is an expensive beast, saddled with heavy labor costs, administrative overhead, and the constant threat of "claims leakage"—overpaying on claims due to simple mistakes or inefficiencies. Automation systematically dismantles these cost centers.

The savings are real. Automating claims processing can deliver a 30% decrease in overall expenses by tightening up workflows and letting your team focus on what matters. When you automate repetitive work like data entry, document sorting, and initial checks, you free up your skilled adjusters for the high-value stuff: investigation, negotiation, and complex decision-making. This doesn't just cut operational costs; it maximizes the impact of your best people. You can dive deeper into the financial advantages of automated insurance claims processing in our detailed guide.

Top-tier platforms like Wamy bring this value to life, allowing organizations to process claim documents 77% faster and resolve cases four times quicker, all without adding headcount. When you realize that every single percentage point gained in straight-through processing can save roughly $1 million per 100,000 claims, the ROI becomes crystal clear. You can learn more about these powerful financial outcomes in ScienceSoft's comprehensive guide.

The difference between the old way and the new way is stark. Let’s look at a direct comparison.

Manual vs Automated Claims Processing A Head-to-Head Comparison

This table illustrates the stark differences in outcomes between traditional manual claims handling and a modern, AI-driven automated approach across key business metrics.

Metric | Manual Processing | Automated Processing |

|---|---|---|

Cycle Time | Days or weeks | Hours or days |

Cost Per Claim | High (labor-intensive) | Low (optimized) |

Error Rate | Prone to human error | Minimal, near-zero errors |

Customer Sat. | Often low, due to delays | High, due to speed & transparency |

Audit Trail | Manual, often incomplete | Automatic, immutable, complete |

Fraud Detection | Relies on adjuster intuition | Systematic, data-driven |

As you can see, the shift isn't just incremental—it's a fundamental upgrade to how the work gets done, impacting every key performance indicator.

Enhance Accuracy and Consistency

Let's be honest: human error is a natural part of any manual process. An adjuster having a long day might misread a form, miss a key detail in a photo, or apply a business rule slightly differently than their colleague. These small slips can add up, leading to incorrect payments, compliance headaches, and unhappy customers.

Automated systems operate with a level of precision and consistency that people just can't replicate. AI algorithms apply your specific business rules to every single claim, every single time, without getting tired or distracted.

This guarantees:

Uniformity: Every claim gets evaluated against the exact same playbook, removing the subjective guesswork that varies from one adjuster to the next.

Reduced Errors: Automated data extraction and validation kill the typos and misinterpretations that plague manual data entry.

Data-Driven Decisions: The system hands your adjusters a structured, objective analysis, giving them a reliable foundation to make their final call.

Achieve Bulletproof Compliance and Audit Trails

Finally, in a heavily regulated field like insurance, compliance isn't optional. Manually documenting every single action on a claim is a slog and often leaves gaps, turning audits into a stressful, all-hands-on-deck fire drill. Automation flips this weakness into a major strength.

Every action taken within an automated system—from the second a document is uploaded to the final payment decision—is logged in an unchangeable audit trail. This creates a transparent, time-stamped history of the entire process, ready to be pulled up at a moment's notice. When an auditor or opposing counsel comes calling, you can instantly produce a complete, verifiable record of the claim. Platforms like Wamy, which are SOC 2 certified, provide the enterprise-grade security and audit-ready outputs that modern carriers, TPAs, and legal teams need to operate with total confidence.

Your Implementation Roadmap for Automation

Switching to an automated claims system can feel like a massive undertaking. But it’s not about flipping a switch and hoping for the best. The right way to think about it is as a journey, one that can be broken down into clear, manageable stages.

Think of it like building a sophisticated assembly line, piece by piece. This roadmap lays out a logical path, starting with the fundamentals of getting your data in order and then progressively layering on intelligence to build a truly powerful workflow.

The visual below shows how automating these key steps directly translates into faster cycle times, real cost savings, and a huge boost in accuracy.

Each stage builds on the one before it, creating a compounding effect that will completely reshape your operational efficiency and business outcomes.

Stage 1: Centralize All Data Intake

The first—and most critical—step is to end the chaos of scattered information. Claims data pours in from everywhere: emails, web portals, faxes, you name it. Without a central hub, your adjusters are burning precious time just trying to find the right documents.

Your initial goal is to create a single, unified workspace where every piece of incoming information lands automatically. This digital command center becomes the undisputed source of truth for every claim, wiping out version control nightmares and ensuring everyone is working from the same complete file. For a deeper look at this, check out our comprehensive guide to AI intake forms for property & casualty claims.

Stage 2: Automate Evidence Tagging and Triage

Once all your data is in one place, the next challenge is making sense of it. Manually sifting through hundreds of photos, forms, and PDFs to figure out what’s what is a massive bottleneck. This is where you bring in AI to do the heavy lifting.

An AI-powered system can instantly:

Categorize documents: It knows a police report from an invoice or a medical record.

Tag evidence: It can spot specific types of damage in photos or key terms in legal filings.

Prioritize information: It flags the most critical evidence for immediate human review.

This automated triage turns hours of tedious admin work into minutes, freeing up your adjusters to focus on analysis, not organization.

Stage 3: Establish First-Pass Assessments

With your data structured and tagged, you can now use AI to perform an initial review of the claim. This isn't about replacing your adjuster’s judgment; it’s about giving them an intelligent head start. The system runs a first-pass assessment, analyzing the consolidated evidence to offer up a preliminary risk evaluation.

Think of this initial analysis as a preliminary diagnostic report for a doctor. It provides a claim confidence score, highlights potential red flags, and summarizes key findings, empowering your team to make faster, more informed decisions right from the get-go.

Stage 4: Implement Automated Gap Detection

One of the biggest culprits for delays? Discovering halfway through that a critical document is missing. This next stage in your roadmap tackles that problem head-on by implementing an automated gap detection system.

As evidence comes in and gets tagged, the AI cross-references it against a predefined checklist for that specific claim type. If a signature is missing from a form or a required photo was never submitted, the system immediately flags the gap. This lets your team request the missing information early, keeping the claim moving forward without hitting those frustrating stalls.

Stage 5: Deploy AI-Powered Assistants

With a solid foundation of data management and analysis in place, you can bring in AI assistants to speed things up even more. These tools are designed to help with two of the most time-consuming parts of an adjuster's day: communication and documentation.

These assistants can draft responses to common questions, summarize long and complex documents, or even generate initial settlement offers based on predefined rules. By taking over these repetitive tasks, they free up your adjusters for high-value work like negotiation and complex problem-solving.

Stage 6: Integrate with Core Systems

For automation to deliver its full value, it can't live on an island. The final implementation steps involve connecting your new claims platform with your existing tech stack, especially your core claims management system (CMS) and payment processing software.

This integration creates a seamless, uninterrupted flow of data across your entire operation. Decisions made in the automation platform can automatically trigger actions in other systems, building a truly connected and efficient ecosystem.

Stage 7: Prioritize Enterprise-Grade Security

Security and compliance can't be an afterthought—they have to be woven into every single stage. From day one, make sure your chosen platform meets rigorous industry standards, like SOC 2 certification. This is your guarantee that all sensitive claim data is handled with the highest level of security, protecting both your business and your policyholders while ensuring every output is audit-ready.

How to Sidestep Common Implementation Pitfalls

Making the switch to automated claims processing is a huge step forward, but let's be honest—the road to get there can have a few bumps. It’s not just about plugging in new software. The real trick is knowing what can go wrong before it does.

If you anticipate the common traps around people, processes, and data, you can build a strategy that avoids the headaches and gets you to the wins faster. Think of it as a preemptive strike against implementation chaos.

Navigating Data Quality and Integration Hurdles

Here’s a hard truth: an automation platform is only as smart as the data you feed it. This is probably the single biggest stumbling block we see. If your claim files are a messy, inconsistent mix of formats, the AI is going to struggle. It’s the classic "garbage in, garbage out" problem, and it will absolutely hamstring your results.

Before you do anything else, start with a data audit. Get a clear picture of what your files actually look like. Where are the gaps? What are the inconsistencies? This is the time to establish clean data standards moving forward. A platform like Wamy, which is built to pull in documents from all over the place and organize them into one clean workspace, gives you a solid foundation from day one.

The other big issue is integration. If your new automation tool can't talk to your core claims management system, you're just creating another silo. Make sure any partner you consider has robust APIs that create a unified ecosystem. You want information to flow freely, not get stuck in digital traffic jams that force your team into manual workarounds.

Overcoming Internal Resistance to Change

Even the slickest technology will fall flat without buy-in from your team. It's natural for adjusters and administrators to see automation and think, "Is a robot coming for my job?" This fear usually comes from not knowing how the system will actually change their day-to-day work.

The best way to get ahead of this is with open communication that focuses on empowerment. Frame the AI not as a replacement, but as an assistant—a tool that handles the tedious, soul-crushing tasks they hate doing anyway.

The goal isn't to replace your experts. It's to free them up to focus on high-value work like complex investigations, negotiations, and strategic decisions—the stuff that actually requires their experience and judgment.

Get them proper training and show them early wins. When your team sees for themselves that the tech is a partner that makes their jobs more impactful (and less annoying), you’ll see adoption take off.

Avoiding Unrealistic Expectations and Scope Creep

It’s easy to get carried away by the promise of 100% straight-through processing on day one. But that’s a recipe for disappointment. A smart implementation is a journey, not a flip of a switch. Start with a well-defined pilot project, focusing on a specific type of high-volume, low-complexity claim.

This approach lets you:

Secure early wins: Nothing builds momentum like quick, measurable success. It gets everyone excited and supportive of the bigger vision.

Learn and adapt: A pilot is your best teacher. You’ll uncover workflow quirks and learn where you need to make adjustments before you go all-in.

Contain scope creep: A phased rollout keeps the project from spiraling into an overwhelmingly complex beast.

Focus on incremental progress. Celebrate the small victories, listen to your team’s feedback, and expand the system’s reach methodically. This measured strategy is what leads to long-term success, not a short-term flameout.

Take fraud detection, for instance. This is an area where automation delivers massive returns by spotting patterns humans would easily miss. AI can identify suspicious activity 50% faster and has the potential to slash fraudulent payouts by up to 40%. The FBI estimates that non-health insurance fraud costs US insurers over $40 billion a year, so this is a big deal. Automated platforms like Wamy use built-in tools like Risk Intelligence and Gap Detection to flag inconsistencies, which can cut false positives in fraud detection by 20-25% and seriously reduce claim leakage. You can dig into more of these eye-opening workflow automation statistics to see the broader impact.

Finding the Right Claims Automation Partner

Picking a vendor to automate your claims is one of the most important decisions you'll make. Get it right, and you’ve found an extension of your team that fuels growth and efficiency. Get it wrong, and you're looking at stalled projects, wasted money, and a whole lot of frustration. This goes way beyond a simple feature-by-feature comparison; it’s about finding a partner whose technology and team truly get what you’re trying to achieve.

You have to ask the right questions to see what’s really under the hood. A flashy demo is one thing, but how the platform performs in the messy reality of day-to-day claims is what counts.

Core AI and Industry Expertise

First things first: how smart is the AI? A generic, one-size-fits-all AI solution just won't cut it in the complex world of property and casualty claims. The platform’s intelligence has to be domain-trained. This means it understands the specific language, documents, and types of evidence unique to P&C insurance.

Ask any potential partner these questions right out of the gate:

Does the AI actually understand P&C claims? Can it tell the difference between a police report and a medical invoice? Can it spot hail damage on a roof versus just normal wear and tear?

How does it handle unstructured data? Claims files are messy. Ask them how the system ingests and makes sense of adjuster notes, long email chains, and blurry scanned documents.

Does the platform get smarter over time? The best partners offer a system that learns and improves, adapting to new claim types and changing regulations without constant hand-holding from your team.

A platform like Wamy, for instance, was built from the ground up for P&C. It uses domain-trained AI to tag evidence with legal and insurance context, turning hours of manual review into minutes. This kind of specialized intelligence isn't a "nice-to-have"—it's a must-have for getting accurate and consistent results.

Security, Scalability, and Integration

Your claims data is incredibly sensitive, so rock-solid, enterprise-grade security is non-negotiable. A vendor’s approach to security tells you a lot about how reliable they'll be as a long-term partner. On top of that, the platform needs to grow with you and plug into the systems you already use.

A claims automation platform should simplify your tech stack, not complicate it. If the solution doesn't integrate easily with your core systems, it risks becoming just another isolated data silo, undermining the very efficiency you seek.

Make sure your evaluation checklist covers these points:

Is the platform SOC 2 certified? This is the gold standard for data security and proves they handle your information responsibly.

Can it handle a CAT event? The system has to be able to manage massive, sudden spikes in claim volume without breaking a sweat. Business continuity is critical when you need it most.

How easily does it connect to our CMS? You’re looking for robust APIs and a proven track record of successful integrations with other core insurance technologies.

User Experience and Support

Finally, technology is only as good as the team using it. If the platform is clunky or confusing, your people won't use it, and you'll never see the promised efficiency gains. The interface needs to be intuitive for everyone, from adjusters on the front lines to your in-house legal team.

Don't forget the human element. Ask about the user experience and the level of support they provide. A true partner invests in your team's success with thorough onboarding, real training, and customer service that actually responds when you need them. When you choose a solution that empowers your people, you guarantee your move into claims automation will deliver its full potential.

Answering Your Questions About Claims Automation

Even with a clear plan, taking a big step like automating your claims process is going to bring up some questions. It's only natural. Here, we’ll tackle the most common ones we hear from leaders just like you, giving you the straight answers you need to see the real-world picture.

Can AI Really Handle Complex Claims?

This is probably the number one concern we hear: can an algorithm handle a claim that needs a human’s judgment? The short answer is, it doesn't have to. The goal isn't to replace your seasoned adjusters; it's to supercharge them.

Think of the AI as the world’s best paralegal. It does all the heavy lifting—organizing massive files, tagging every piece of evidence, and running an initial risk assessment. This hands a complete, perfectly structured file to your expert. They can then jump straight into the nuanced, high-stakes decisions that genuinely need their experience, instead of burning hours on administrative grunt work.

What's the Typical Return on Investment?

While the exact numbers will vary, most firms see a significant return on their investment within 6 to 12 months. That ROI comes from a powerful mix of benefits that build on each other over time.

Serious Cost Savings: You’re cutting down on manual labor, catching more errors before they become costly, and plugging sources of claim leakage. It all adds up directly on your bottom line.

Fraud Reduction: The AI is brilliant at spotting suspicious patterns that a human might miss, helping you shut down fraudulent payouts before they happen.

Faster Resolutions: Quicker cycle times mean less administrative drag on each claim and a healthier cash flow for the business.

How Painful Is System Integration?

The idea of plugging yet another platform into your tech stack can be intimidating, but modern systems are built to connect. The best automation platforms use robust APIs (Application Programming Interfaces) that work like a universal adapter, letting them talk to your existing Claims Management System (CMS) and other core software without a fuss.

The real key is picking a vendor that sees integration support as part of the deal. A true partner works hand-in-glove with your team to make sure everything connects smoothly, creating a single, unified system instead of just another data silo.

How Does This Actually Help the Policyholder?

At the end of the day, automating claims processing has a direct and massive impact on your customer. Policyholders today expect speed and transparency. A slow, confusing claims experience is one of the fastest ways to lose them for good.

Automation delivers what they want: faster processing, clear updates, and quicker payouts. That efficiency creates a genuinely better customer journey, building trust and loyalty right when it matters most.

Ready to turn your claims operation from a cost center into a competitive advantage? Wamy’s AI-powered platform transforms raw claim data into confident, audit-ready decisions, helping you resolve claims up to 4x faster. Discover how Wamy can streamline your workflow today.

© 2025 Wamy. All rights reserved.