The Modern Case Management Solution for P&C Claims

Jan 17, 2026

Discover how a modern case management solution transforms P&C claims. Learn key features, benefits, and how to choose the right platform to boost efficiency.

Think of a modern case management solution as the command center for your entire P&C claims operation. It’s a smart software platform designed to bring order to the chaos, taking tangled streams of emails, documents, and photos and turning them into a single, structured, and audit-ready case file. The result? Faster, more consistent decisions from your team.

What Is a Modern Case Management Solution?

Let’s use an analogy. Imagine an air traffic control tower for your claims. Right now, you might feel like you’re waving signal flags in a storm, with disorganized files and evidence arriving from dozens of different sources. A modern case management solution acts as that central tower. It doesn't just passively store information; it intelligently organizes, triages, and directs every piece of incoming evidence.

This transforms the traditionally frantic claims process into a unified, manageable workflow. For too long, carriers, TPAs, and law firms have been stuck with what are essentially digital filing cabinets—systems that hold data but do little to make it useful. A true case management platform moves beyond this outdated role. It becomes a proactive engine that guides adjusters and legal teams, tracks critical evidence, and makes sure every claim is handled with precision.

The Shift from Filing Cabinet to Command Center

The real headache in P&C claims isn’t a lack of information; it’s an overabundance of unstructured data. Emails, PDFs, photos, medical records, and legal briefs create a messy web that slows down decisions and multiplies risk. A modern solution is built to solve this exact problem.

It creates a single source of truth where every document is not just stored but actually understood. AI-powered features analyze content, tag key details, and flag missing items, turning a jumble of files into a perfectly organized evidence locker.

A modern case management solution doesn't just manage cases; it manages the chaos within them. By imposing structure on unstructured data, it creates the clarity needed for confident, fast, and compliant claims resolution.

This shift is a game-changer for organizations drowning in complex, evidence-heavy claims. The platform becomes an active participant in the claims journey, ensuring nothing falls through the cracks and every decision is backed by a complete, auditable record.

The market is clearly moving in this direction. Globally, the case management software market was valued at about USD 8.26 billion in 2024 and is projected to hit USD 24.09 billion by 2034, growing at an annual rate of roughly 11.3%. For P&C firms, this trend is fueled by pressure on combined ratios and rising litigation, making AI-assisted platforms a necessity, not a luxury. You can explore more data on this market growth on Precedence Research.

Before we dig into the features, it's helpful to see a side-by-side comparison of the old way versus the new way of handling claims.

Traditional vs. Modern P&C Case Management

Aspect | Traditional Approach | Modern Solution |

|---|---|---|

Data Intake | Manual uploads, email attachments, physical mail. Highly fragmented. | Automated ingestion from all channels (email, portal, API). |

File Organization | Folder structures that rely on human discipline. Often inconsistent. | AI-powered, self-organizing file. Evidence is auto-tagged and categorized. |

Workflow | Manual checklists, spreadsheets, and tribal knowledge. Prone to errors. | Automated, customizable workflows that guide users step-by-step. |

Evidence Review | Adjusters manually read every document to find key information. | AI summarizes documents, identifies key entities, and flags missing items. |

Visibility | Siloed information; management gets reports that are already outdated. | Centralized dashboard with real-time visibility into every case and workload. |

Compliance | A manual, time-consuming effort to assemble an audit trail after the fact. | Automatic, unchangeable audit trail of every action, ready for review anytime. |

Decision Making | Based on adjuster experience and the information they can find. | Data-driven, guided by AI insights and a complete, structured evidence file. |

This table shows a clear evolution. The modern approach isn't just a faster version of the old one—it's a fundamentally smarter way to work.

How It Solves Core P&C Challenges

A well-designed case management solution directly tackles the primary pain points that drag down efficiency and profitability in the P&C world. It provides tangible fixes for those persistent operational headaches.

Here are a few key challenges it solves right away:

Information Overload: It automatically ingests and categorizes documents from multiple channels, ending the manual sorting that eats up adjuster time.

Inconsistent Processes: By using automated workflows, it ensures every claim follows your organization’s best practices, cutting down on human error and compliance risks.

Lack of Visibility: Centralized dashboards give you a real-time, 30,000-foot view of every case, instantly highlighting bottlenecks, missing evidence, and team workloads.

Audit and Compliance Burdens: The system builds an unchangeable, time-stamped record of every action, making regulatory audits straightforward and much easier to defend.

Core Features That Drive Claims Efficiency

To really get what a modern case management solution does, you have to look under the hood. Its value isn't just about storing files. It’s about how its features work together to turn a chaotic, unpredictable claims process into a smooth, efficient operation. These are the gears that drive faster, more accurate outcomes.

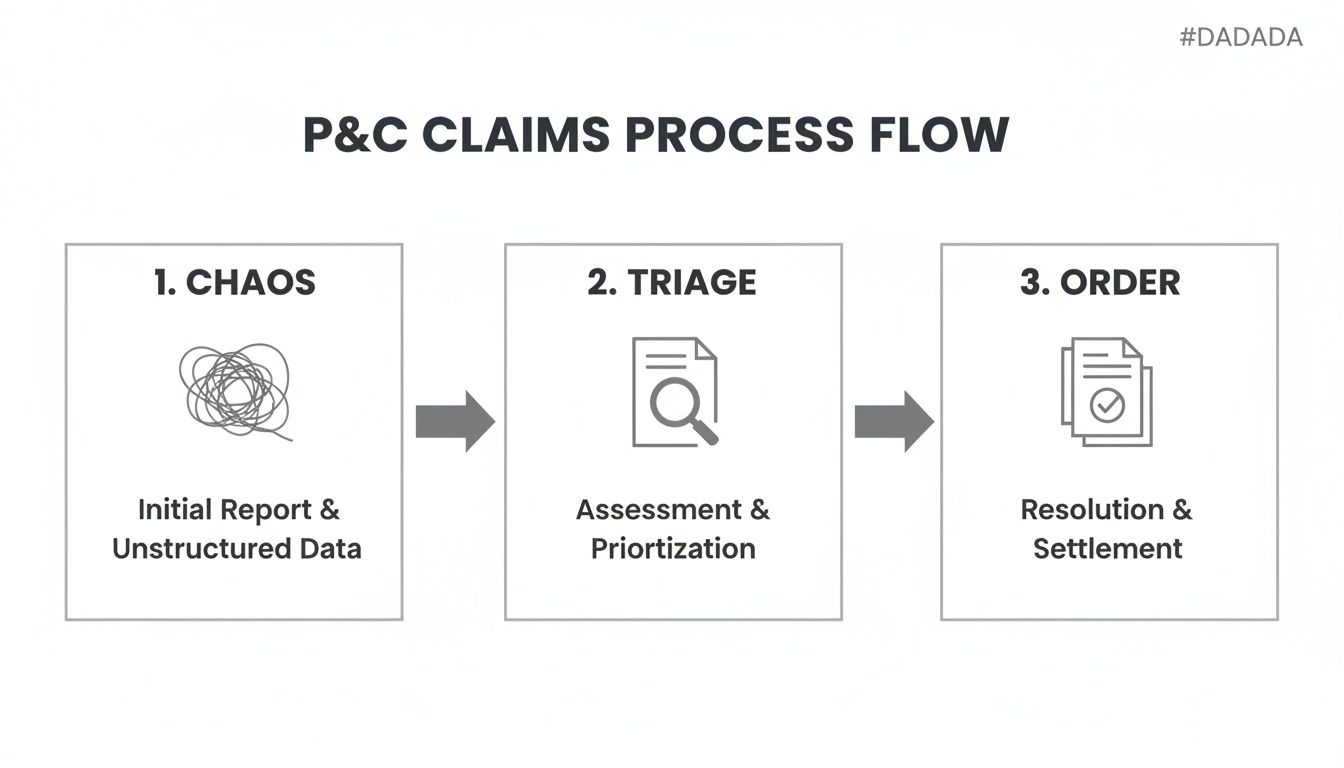

The journey from a messy pile of submitted documents to a structured, decision-ready file is the key transformation. This visual shows exactly how a case management solution brings order to the initial chaos of a P&C claim.

As you can see, the platform’s first job is to move from a tangled mess of data to a systematically organized file. This lays the groundwork for everything that follows.

Intelligent Intake and Centralization

If a claims process is going to fail, it often starts right at intake. Information flies in from everywhere—emails, client portals, third-party uploads, even snail mail. Without a central hub, documents get lost, adjusters waste hours on manual data entry, and nobody has a clear picture of what’s going on.

An intelligent intake feature is like a smart, automated receptionist for all that incoming data. It automatically grabs and consolidates documents from every channel into a single, unified workspace. This isn't just about storage; it’s about creating a complete picture of the claim from the moment it arrives.

By automating the collection and centralization of claim documents, organizations can gather necessary files up to 77% faster. This initial burst of speed prevents early-stage bottlenecks that cause delays to snowball down the line.

From day one, every stakeholder is looking at the same complete, up-to-date file. No more frantic searches for "that one email" or a missing police report.

Evidence Management and Organization

Once everything is in one place, the next hurdle is making sense of it all. A typical claim file can contain hundreds of unstructured documents—photos, PDFs, medical records, legal briefs. Manually sorting and tagging this mountain of evidence is a massive time sink for your adjusters.

A modern case management solution uses AI to act as an expert evidence organizer. It automatically scans, tags, and categorizes every single piece of evidence based on its content and relevance.

Document Recognition: The system knows a police report from a medical invoice and tags them correctly.

Photo Analysis: It can sort images by type, like "property damage" or "vehicle interior," making them instantly findable.

Content Extraction: AI can even pull out key information like names, dates, and policy numbers directly from the documents themselves.

This automated organization turns a digital junk drawer into a perfectly structured evidence locker, where every item is labeled and ready for review.

AI-Powered Triage and Analysis

With a perfectly organized file, the next step is analysis. Traditionally, an adjuster spends hours doing a first-pass review to gauge the claim's complexity, spot risks, and identify what's missing. This is where AI-powered triage delivers a huge advantage.

The system gives you an instant first-pass assessment of the entire case file. Think of it as an experienced assistant who can review all the evidence in seconds to surface critical insights. For carriers and TPAs wanting to master this crucial first step, it’s worth understanding the technology behind it. You can dive deeper in our comprehensive guide to AI intake forms for property and casualty claims management.

This AI analysis flags important details an adjuster might otherwise miss:

Risk Intelligence: It can assign a claim confidence score based on the strength of the available evidence.

Gap Detection: The system automatically points out missing documents or inconsistencies in the record.

Key Entity Identification: It highlights the critical people, places, and events mentioned across multiple documents.

This immediate analysis lets your team prioritize high-risk claims, request missing information sooner, and make smarter strategic moves from the very beginning.

Automated Workflows and Compliance

Inconsistency is the enemy of both efficiency and compliance. When every adjuster handles claims a little differently, it invites errors and turns audits into a nightmare. Automated workflows solve this by building your organization's best practices right into the platform.

These workflows guide users through a predefined set of steps for different claim types, making sure nothing gets missed. Tasks are automatically assigned, deadlines are tracked, and escalations are triggered based on rules you set.

This structured approach gives you two massive benefits. First, it ensures every claim is handled with the same high standard of care. Second, it creates an unchangeable, time-stamped audit trail of every action taken on a file. This "always-on" audit feature means you're perpetually ready for regulatory review with a complete, defensible record of your entire decision-making process.

Measuring the ROI of a Smart Case Management Solution

So, how do all these advanced features actually translate into dollars and cents? It's easy to talk about "efficiency," but for P&C leaders, the real question is how a smart case management solution connects to tangible business outcomes. The return on investment (ROI) isn't just about saving a bit of time—it's about cutting real costs, dodging risks, and building a more durable claims operation from the ground up.

The most immediate win is in your claim cycle times. When documents are pulled in and triaged automatically, the whole process just moves faster. This isn't a small adjustment; it's a fundamental change in how quickly you can get things done.

This speed has a ripple effect. Quicker resolutions mean lower administrative overhead, smaller loss adjustment expenses (LAE), and happier customers—which has a direct impact on retention rates.

Calculating Direct Cost Savings

Let's break down the metrics that really hit the bottom line. The biggest ROI drivers come from slashing the manual labor tied to every single claim file. When you automate triage and evidence organization, you directly lower the cost per claim by cutting down the hours adjusters spend on administrative grunt work.

Think about it this way: vendors and early adopters consistently report that digitized case workflows and automated document capture cut case handling times by 20–40%. In the P&C world, a 25% reduction on a claim that typically takes 30 days means you’re closing that file 7–8 days faster. Now, scale that across 50,000 annual claims. Over three years, you're looking at reclaiming somewhere between 350,000 and 400,000 adjuster-days. That's a massive amount of time freed up. You can dig into similar market findings from Maximize Market Research.

This reclaimed time allows your existing team to handle a higher volume of claims without you needing to hire more people, giving you serious operational leverage.

Mitigating Compliance and Litigation Risks

Beyond the direct efficiency boost, a modern case management solution is a powerful risk mitigation tool. We all know that inconsistent workflows and shoddy audit trails are huge liabilities that can lead to eye-watering fines or losing in court.

Automated workflows ensure every claim follows your best practices and meets regulatory standards, every single time. The platform creates an unchangeable, time-stamped audit trail of every decision, every document review, and every piece of communication.

This "always-on" audit readiness changes compliance from a reactive fire drill into a proactive, built-in function. It gives you a defensible record that can dramatically cut the costs tied to regulatory fines and legal battles.

Trying to achieve this level of consistency with manual processes is next to impossible. The ROI here isn't just in what you save—it's in the penalties and legal fees you avoid.

Unlocking Strategic Value and Scalability

The strategic ROI is where things get really interesting, as it speaks to the long-term health of your operation. By putting structure around previously chaotic data, the platform delivers insights that sharpen settlement accuracy and drive better business decisions.

Here are a few of the key strategic benefits:

Scalable Growth: Your team can handle more claims without you having to proportionally increase staff. This lets you grow your business without watching your operational costs explode.

Improved Settlement Accuracy: When adjusters have a complete, organized evidence file at their fingertips, they can make more confident, data-backed settlement decisions. This reduces the risk of overpaying or underpaying on claims.

Enhanced Adjuster Focus: By automating the administrative drag, the system frees up your most experienced people to focus on what they do best: negotiating, investigating, and talking to customers.

This strategic lift is a huge part of the value. To learn more about these advantages, take a look at our guide on the top benefits of automated insurance claims for efficiency, accuracy, and cost savings. At the end of the day, investing in a smart case management solution is about building a more efficient, compliant, and intelligent claims organization that’s ready for the future.

How to Choose the Right Solution for Your Team

Picking the right case management solution feels like a high-stakes decision, and it is. But it doesn’t have to be overwhelming. The trick is to tune out the marketing noise and zero in on the capabilities that solve your team’s real-world operational headaches. A structured evaluation helps you find a true partner, not just another software vendor.

Think of it like building a custom toolkit for a specialized engine. You wouldn't grab a generic wrench set from a hardware store; you’d need instruments precision-engineered for the job. Your evaluation should prioritize platforms built from the ground up with the unique complexities of P&C claims in mind.

Start with Your Core Needs

Before you even sit through a single demo, you need to get brutally honest about what a "win" looks like for your organization. Are you drowning in manual intake? Trying to slash claim cycle times? Or maybe you're focused on mitigating compliance risks. Your answers are the bedrock of your evaluation checklist.

Getting clear on your goals keeps you from being distracted by flashy features that don’t actually move the needle on your biggest pain points. This first step is non-negotiable if you want to see a measurable return on your investment.

The most effective approach is to identify your top three operational bottlenecks. A great case management solution should offer a direct, demonstrable fix for those specific issues, turning your biggest headaches into sources of efficiency.

Once your priorities are straight, you can start sizing up potential vendors against a clear set of criteria. The objective here is to push past generic promises and dig into the nitty-gritty of how a platform will actually perform in your day-to-day reality.

The Essential Vendor Evaluation Checklist

Choosing the right partner is about asking the right questions. Use this checklist when you talk to vendors to cut through the sales pitch and understand if their platform is truly the right fit for your carrier, TPA, or law firm.

Category | Key Question to Ask | Why It Matters |

|---|---|---|

Industry Specialization | Is the platform's AI trained specifically on P&C claims data? | Generic AI won't know the difference between a police report and a medical record. P&C-specific training is what allows the system to accurately tag, categorize, and make sense of your unique evidence types right out of the box. |

Security and Compliance | Can you provide your SOC 2 or HIPAA compliance certifications? | P&C claims are built on a foundation of highly sensitive data. You need verifiable, enterprise-grade security—it’s non-negotiable for protecting your clients, your firm, and your reputation from breaches and regulatory fines. |

Integration Capability | How does your solution integrate with our existing claims management system (CMS)? | The platform has to play nice with your current system of record. Look for pre-built connectors and a smart API strategy to avoid creating frustrating data silos or forcing your team to toggle between screens all day. |

Workflow Customization | Can we configure the workflows to match our established best practices? | The solution should adapt to your processes, not the other way around. A flexible platform lets you digitize and automate your proven methods, making your team more effective without forcing them to relearn their jobs. |

Scalability and Performance | How does the platform handle sudden spikes in claim volume, like during a CAT event? | Your solution has to be able to scale on demand without breaking a sweat. A cloud-native architecture is critical for maintaining performance and reliability when your team is under the most pressure. |

Onboarding and Support | What does your implementation process look like, and what kind of support do you offer post-launch? | A smooth, structured onboarding is the key to fast adoption and a quick ROI. You're looking for a vendor that provides dedicated support and acts like a long-term partner invested in your success. |

This framework helps ensure you’re not just buying software, but investing in a solution that understands and solves the specific challenges of P&C claims.

Prioritize Actionable ROI

Finally, any vendor worth your time should be able to draw a straight line from their platform's features to the ROI metrics we talked about earlier. Challenge them. Ask them to show you exactly how their automated triage lowers the cost per claim or how their centralized intake shrinks claim cycle times.

A confident partner will have case studies and hard data to back up their claims. That’s the kind of proof you need to make the right choice with confidence.

See It in Action With Real-World Examples

All the talk about features and benefits is one thing, but seeing a modern case management solution in the real world is where its value really clicks. To make this tangible, let's walk through three distinct scenarios where this technology makes a measurable difference for carriers, TPAs, and law firms.

Each story highlights a common industry headache, a practical application of the solution, and a result you can actually measure.

These aren't just hypotheticals. They reflect the daily grind that P&C organizations face and show exactly how intelligent automation can reshape their workflows for the better.

Scenario One: The Overwhelmed National Carrier

Picture a large national insurance carrier drowning in high-volume, low-complexity auto claims. Their adjusters are completely buried in administrative work—manually sorting a constant flood of emails, photos, and police reports for thousands of claims every month. This creates a massive backlog, pushing claim cycle times to an average of 45 days and dragging down customer satisfaction scores.

They bring in a case management solution with AI-powered intake and triage. Now, the moment a claim is filed, the system automatically pulls in all the documents from every channel, categorizes them, and runs an initial analysis.

The Result: The automated system immediately identifies claims with clear liability and complete documentation, flagging them for fast-track settlement. This simple change clears the backlog of simple claims, slashing the average cycle time by 30% in the first six months. Adjusters are finally free from the administrative overload, allowing them to apply their expertise to more complex cases. The result is not just better efficiency but also a boost in morale and settlement accuracy.

Scenario Two: The TPA Juggling Complex Liability

A third-party administrator (TPA) is managing complex general liability claims for several large commercial clients. The problem? Every client has unique reporting requirements and service-level agreements (SLAs). Keeping everything consistent and compliant is a constant struggle, with manual checklists and shaky workflows leading to missed deadlines and audit risks.

By adopting a case management platform, the TPA digitizes and standardizes its entire process. For each client, they configure specific, automated workflows that guide adjusters through every single step, from initial investigation to final resolution.

The platform provides a central dashboard with a real-time view of every claim's status and how it's tracking against client-specific SLAs. This is a game-changer for process control, ensuring every claim is handled precisely according to client standards—a core tenet of automating routine legal and property and casualty claim workflows.

Key Application: Customizable, automated workflows ensure every adjuster follows the exact same best practices for each client account. No more guesswork.

Compliance Control: The system automatically generates a complete, unchangeable audit trail of every action taken, making client and regulatory reviews straightforward and defensible.

The Result: The TPA practically eliminates missed deadlines and compliance errors, which drives a 95% client retention rate. More importantly, the ability to give clients transparent, real-time reporting on their claims becomes a powerful competitive differentiator, helping them land new business.

Scenario Three: The Subrogation-Focused Law Firm

A law firm specializing in P&C subrogation needs to build ironclad cases to maximize recoveries for its carrier clients. This means painstakingly assembling a complete evidence file. But their paralegals spend countless hours manually chasing down missing documents, photos, and expert reports, limiting how many cases the firm can handle and delaying recoveries.

The firm puts a case management solution with AI-powered gap detection to work. The system automatically scans each new case file, comparing the available evidence against a predefined checklist for that specific type of claim.

It instantly flags anything missing—like a witness statement or an unsigned medical release—and can even draft and send automated requests for the outstanding information. What was once a reactive, manual chore becomes a proactive, automated one.

The Result: The firm cuts the time spent on evidence collection by over 50%. Paralegals can now get files litigation-ready in a fraction of the time, allowing the firm to boost its caseload by 20% without adding headcount. Faster case preparation directly translates to quicker settlements and better recovery outcomes for their clients.

Answering Your Key Questions

Making the leap to a new case management solution is a big move, and it’s smart to have questions. Leaders want to know exactly how this kind of technology fits with their current systems, what the rollout will actually look like, and how much control they’ll have over the processes they’ve spent years perfecting.

This section tackles the most common questions we hear from the field. The goal is to give you straightforward answers, clear up any concerns, and build your confidence that this kind of platform will work for your team, not against it.

How Is This Different From Our Claims Management System?

This is probably the most important question leaders ask, and getting the distinction right is crucial.

Think of your existing Claims Management System (CMS) as the bank vault. It’s the secure, official system of record. It’s where the most critical financial data lives—reserves, payments, and the final status of a claim. Your CMS is built for structured data and financial precision.

A modern case management solution is the workshop where all the messy, real-world work gets done. It’s designed to handle the chaos of unstructured evidence that defines every complex P&C claim: the flood of photos, the endless email chains, the dense legal briefs, and the stacks of medical records. It uses AI to bring order to that chaos, assemble a complete file, and guide the adjuster toward a well-documented decision.

In short, the case management solution is the "work-in-progress" engine that prepares the case. The CMS is the "system-of-record" that logs the final outcome. They’re partners, not competitors.

Once the heavy lifting is done—the evidence analyzed, the file organized—the case management platform feeds a clean, structured, and audit-ready package to the CMS. This integration is key. It lets data flow seamlessly without forcing your team to waste time on duplicate data entry.

What Is a Realistic Implementation Timeline?

The mere thought of a long, disruptive software deployment is enough to give any operations leader a headache. Thankfully, the days of multi-year, consultant-heavy projects are largely over for this class of software. Modern cloud-based solutions are built for speed, not for endless custom coding and on-site hardware installations.

For a new case management solution, a typical implementation ranges from a few weeks to a couple of months—not quarters or years. The process is usually managed from start to finish by the vendor.

Here's a look at the typical phases:

Discovery and Workflow Mapping: The vendor’s team sits down with yours to understand your current processes and where the real pain points are.

System Configuration: The platform is then set up to match your specific intake rules, evidence tags, and workflow needs.

Integration Setup: Connections are established with your essential systems, like your CMS and email servers.

Team Training and Rollout: Your users get trained on the new platform, often in phases to ensure everyone is comfortable and the transition is smooth.

The best vendors will hand you a clear, step-by-step onboarding plan to get you running quickly. This accelerated timeline means you can start seeing a return on your investment much faster, often with measurable efficiency gains inside the first quarter.

Can We Customize the Platform for Our Workflows?

Absolutely. In fact, this should be a non-negotiable feature. While a good solution comes with pre-built workflows based on industry best practices, its real value is in its flexibility. Your organization has spent years—maybe decades—refining processes that work for your specific lines of business. A modern platform isn't here to erase that institutional knowledge; it’s here to digitize and supercharge it.

You should expect a high degree of control over how the platform operates. That includes the ability to customize:

Intake Rules: Define exactly how different types of documents are automatically sorted and handled when they arrive.

Evidence Tags: Create custom tags and categories that match your firm's own terminology.

Task Lists and Checklists: Build automated workflows that mirror your standard operating procedures for different claim types.

User Roles and Permissions: Ensure the right people have access to the right information, keeping everything secure and confidential.

The platform should adapt to how you work, not the other way around. This configurability ensures your team can become more efficient without giving up the proven strategies that make them so effective. It’s all about amplifying their expertise, not forcing them into a rigid, one-size-fits-all box.

Ready to see how an AI-powered platform can transform your claims process? Wamy turns raw, unstructured claim data into confident, audit-ready decisions. Centralize your intake, automatically organize evidence, and resolve claims up to four times faster.

© 2025 Wamy. All rights reserved.