A Practical Guide to Enterprise Claims Management

Jan 17, 2026

Discover how a modern enterprise claims management system transforms operations for carriers and TPAs, driving efficiency, reducing costs, and boosting ROI.

Enterprise claims management isn't just a piece of software; it's a strategic overhaul of how you handle the entire lifecycle of an insurance claim. Think of it as your unified command center, replacing the chaotic mess of disconnected spreadsheets, overflowing inboxes, and siloed data with a single, coordinated process. This approach is about more than just processing files—it's about orchestrating your data, people, and workflows to guide every claim from its first notice to its final resolution.

Defining Your Claims Operations Command Center

The best way to picture enterprise claims management is as the air traffic control system for your entire claims operation. Instead of individual adjusters trying to land their own planes with limited visibility, this system gives you a complete, holistic view of every incoming "flight" (claim). It coordinates each one, ensuring a safe and efficient path from takeoff (First Notice of Loss) to landing (final settlement).

This centralized model is absolutely critical for carriers, Third-Party Administrators (TPAs), and law firms trying to navigate today's incredibly complex risk environment. It's not about shuffling individual files anymore. It’s about intelligently overseeing a massive ecosystem of data, documents, stakeholders, and compliance deadlines. By pulling everything into one cohesive framework, organizations finally get the oversight they need to prevent costly errors, crush delays, and make sharp, data-driven decisions at scale.

From Manual Chaos to Strategic Control

Let’s be honest: without a unified system, claims operations often feel like organized chaos. Adjusters burn hours hunting for documents buried in email threads, manually punching data into multiple systems, and struggling to keep assessment standards consistent across the team. This fragmented, manual grind creates huge operational drag and introduces serious risk.

A modern enterprise claims management system completely flips that dynamic on its head. It automates the "first mile" of data collection, intelligently categorizes incoming evidence, and provides an immediate, context-aware risk assessment. This shift empowers your team, transforming them from administrative data-entry clerks into strategic decision-makers. The goal is to build a fully auditable, transparent, and efficient workflow that works better for everyone involved.

A core principle of enterprise claims management is creating a single source of truth. When all stakeholders work from the same validated information, it reduces disputes, accelerates resolutions, and builds trust with policyholders.

Key Pillars of an Effective System

An effective system is built on several key pillars that work in concert to create a seamless operational flow. These are the essential components that turn raw, unstructured claim data into actionable insights and confident, audit-ready outcomes.

At its heart, the system must deliver on four key functions:

Centralized Intake: Automatically pulling in and organizing all claim-related documents from any source—whether it's email, an upload portal, or snail mail—into a single, consolidated workspace.

Intelligent Triage: Using domain-trained AI to analyze and categorize every piece of evidence based on its legal and insurance relevance, cutting down manual review time from hours to just minutes.

Risk Assessment: Providing a data-driven, first-pass analysis of each claim. This often includes a "claim confidence score" to help your team immediately prioritize high-risk or complex cases.

Workflow Orchestration: Making sure every claim follows a consistent, predefined path with clear accountability, automated task assignments, and transparent status tracking.

By integrating these functions, an enterprise claims management platform doesn't just manage claims—it optimizes the entire operational fabric of your organization.

Mapping the Modern Claims Workflow

To really get a feel for what enterprise claims management can do, you have to look under the hood. The journey from a first report of an incident to a final, fair settlement isn't one big step—it's a series of connected stages. When you get this workflow right, you can turn a chaotic, paper-drenched process into a smooth, fully auditable operation.

Think of it like a high-tech manufacturing line. Raw materials (all those unstructured claim documents) go in one end, and a finished product (a resolved claim) comes out the other. Each station along the way adds specific value, making sure nothing gets missed and the outcome is consistent and reliable every single time.

The First Mile: Centralized Intake

It all kicks off with centralized intake, which is basically a digital mailroom that never sleeps. In the old way of doing things, claim documents would trickle in from all over the place—emails, client portals, faxes, even physical mail. This immediately creates a massive bottleneck as people scramble to manually collect, scan, and sort everything.

A modern intake system completely solves this "first mile" problem. It automatically pulls in documents from any source, funneling everything into a single, organized workspace for each claim. This doesn't just save hundreds of administrative hours; it gives you a complete, real-time picture of all the information from the very start. Nailing this initial data collection sets the stage for a much faster and more accurate process down the line. To see this first step in action, you can learn more about how to set up AI intake forms for property and casualty claims management.

The Second Stage: Evidence Refinement

Once all the documents are in one place, the next phase is evidence refinement. If intake is the mailroom, then refinement is the expert librarian. It’s not enough to just have the documents; you need to know what they mean and how they all fit together.

This is where domain-trained AI really shines. An evidence refinery does way more than simple optical character recognition (OCR). It actually reads and understands documents with the built-in context of legal and insurance requirements.

Intelligent Tagging: It spots and tags key information like medical bills, police reports, property damage photos, and witness statements.

Categorization: It sorts evidence into logical folders, so adjusters can find exactly what they need in seconds.

Data Extraction: It pulls out critical data points—dates, names, policy numbers, injury types—and puts them into a structured format for analysis.

This automated triage cuts the time spent on manual document review from hours down to minutes. This frees up your adjusters to focus on the high-value work: analysis and decision-making.

By structuring unstructured data at the refinement stage, an enterprise claims management system turns a mountain of chaotic information into an organized, queryable asset. This is the critical step that enables all subsequent intelligent actions.

The Third Stage: Intelligent Risk Assessment

With all the evidence neatly organized and refined, the system can now run an intelligent risk assessment. This stage acts as a crucial first-pass analysis, giving adjusters and managers an instant read on a claim's potential complexity and severity. Think of it as having an expert co-pilot on board, offering a data-driven second opinion.

Often, this takes the form of a claim confidence score. The AI weighs all the refined evidence against historical data and predefined rules to flag potential red flags. For example, it might spot a discrepancy between a claimant's statement and a police report, or identify missing documents that are crucial for compliance. This proactive gap detection lets teams get ahead of problems before they spiral, ensuring a more thorough investigation from day one.

The Final Stage: Streamlined Resolution

The last stage is all about streamlined resolution. With a solid foundation of organized evidence and a clear risk assessment, the path to closing the claim becomes much quicker and more predictable. All the heavy lifting up front enables adjusters to act with confidence and efficiency.

Activities in this final stage often include:

Automated Communications: Generating routine letters and notifications without any manual effort.

Drafting Assistance: Using AI to help draft settlement offers or denial letters based on the claim evidence.

Task Management: Assigning and tracking tasks to create clear accountability and ensure timely follow-up.

Audit Trail: Maintaining a complete, unchangeable record of every single action taken on the claim.

Each piece of this workflow builds on the last, creating a powerful compounding effect. A clean intake leads to better refinement, which enables an accurate assessment, which ultimately drives a faster, more cost-effective resolution.

Unsticking the Gears of Claims Management

Even the sharpest claims teams eventually run into friction. The old way of managing claims often feels like trying to navigate a new city with a map from the last century—you’ll get there, but not without hitting every single roadblock along the way. These bottlenecks aren't just minor irritations; they inflate costs, drag out cycle times, and slowly erode customer trust.

A misplaced document can put a major commercial property claim on ice for weeks. An inconsistent assessment between two adjusters can spiral into a compliance nightmare or a costly legal dispute. On their own, they seem small, but over time these inefficiencies build up, creating a systemic drag that slows the entire organization down.

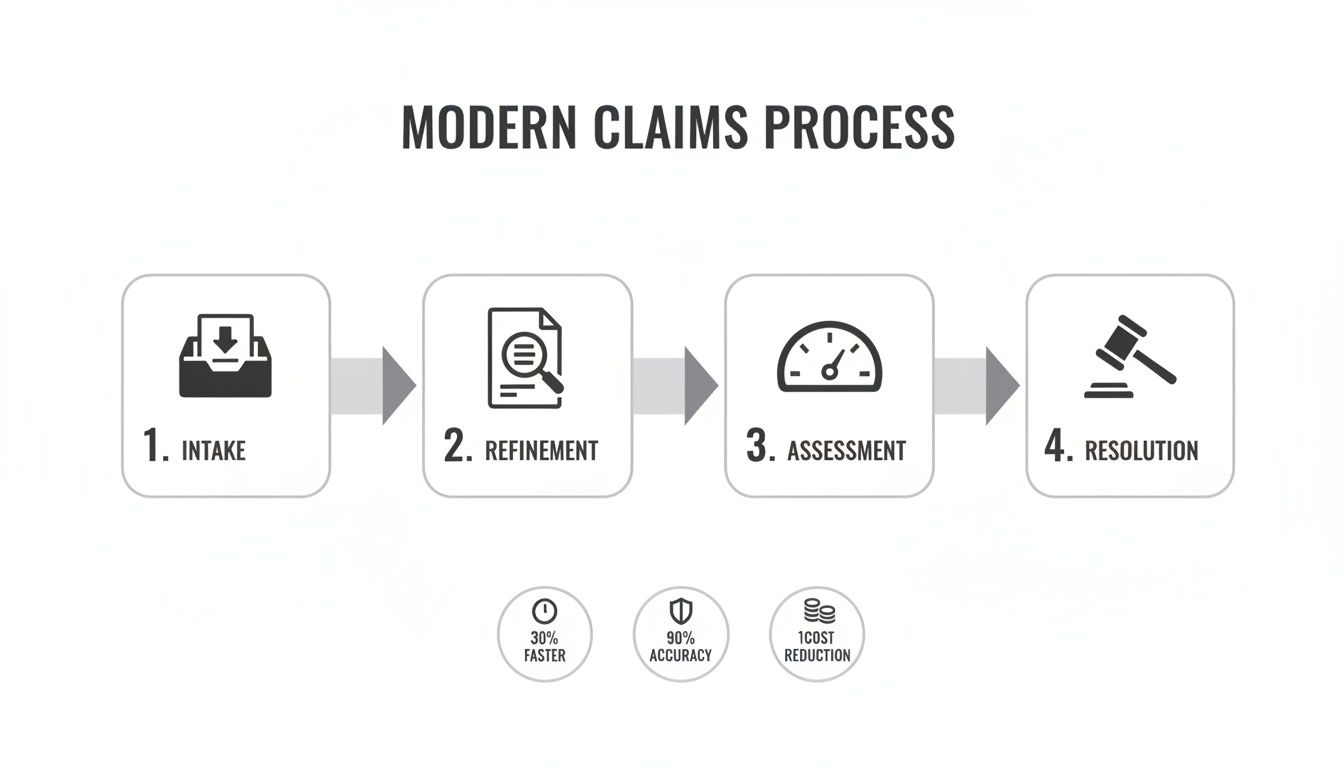

The flowchart below shows how a modern, structured workflow cuts right through that old-school chaos, creating a clear and direct path from first notice to final resolution.

You can see how each step logically flows into the next. It’s a system designed to turn a jumble of incoming information into a clean, actionable file that’s ready for a fast, accurate decision.

Breaking Down Data Silos and Ditching Manual Triage

One of the biggest culprits behind the slowdown is data silos. Critical claims information gets stranded on disconnected islands—an adjuster’s inbox, a clunky legacy system, a third-party vendor portal. This forces your team to become detectives, spending hours just piecing together the full story of a claim.

This scavenger hunt gets even worse with manual document triage. A new claim doesn't just arrive; it arrives with an avalanche of unstructured files. Teams burn precious time opening each one, figuring out what it is, renaming it, and dragging it into the right folder. It's tedious, mind-numbing work that is ripe for human error—the kind of error that causes major headaches down the line.

A modern enterprise claims management platform acts as a central nervous system. It automatically pulls in and categorizes every document, breaking down the silos and killing the manual busywork. Everyone, from the adjuster to legal, works from the same complete, up-to-the-minute file.

Plugging the Leaks from Fraud and Inconsistency

Beyond the operational drag, old systems are leaky buckets when it comes to a much more expensive problem: fraud. For property and casualty (P&C) carriers and TPAs, the scale is staggering. P&C fraud sucks an estimated $45 billion out of the industry every year, representing about 10% of all claim payouts.

That financial drain gets worse when you add inconsistent assessments to the mix. Without standardized tools, adjusters are left to rely on their own judgment, leading to wildly different outcomes for similar claims. This isn't just unfair to policyholders; it’s a direct invitation for compliance violations and serious damage to your brand’s reputation. Getting this right is one of the core property and casualty claims case management best practices for maintaining control and fairness.

The table below contrasts the old, broken process with the new, intelligent approach.

Traditional vs Modern Enterprise Claims Management

Challenge Area | Traditional Approach (The Bottleneck) | Modern Solution (The Breakthrough) |

|---|---|---|

Data & Documents | Information is fragmented across emails, spreadsheets, and disconnected systems. Manual sorting leads to errors and delays. | A unified platform ingests and organizes all data automatically, creating a single, reliable source of truth for every claim file. |

Operational Workflow | Relies on manual hand-offs, checklists, and subjective human memory. Key steps are easily missed. | An intelligent, automated workflow guides adjusters, flags missing information, and ensures every step is completed consistently. |

Fraud & Risk | Fraud detection is reactive, often relying on random audits or gut feelings. High-value risks are missed until it's too late. | AI proactively scores files for fraud, litigation, and subrogation risk from day one, allowing teams to prioritize effectively. |

Consistency | Outcomes depend heavily on the individual adjuster's experience and judgment, leading to variable results and compliance issues. | Standardized processes and data-driven insights ensure fair, consistent, and defensible claim decisions across the entire team. |

Customer Experience | Slow processing, lack of transparency, and frustrating communication create distrust and drive customers away. | Faster cycle times, proactive updates, and accurate outcomes build policyholder trust and improve retention. |

It's clear that the modern approach isn't just an upgrade—it's a complete reimagining of how claims should be handled.

Connecting Bottlenecks to Your Bottom Line

To really make the case for moving forward, you have to draw a straight line from these operational headaches to real business costs. Every single challenge directly hits the bottom line.

Bloated Operational Overhead: Every hour your team spends hunting for documents, doing manual data entry, or fixing errors is a direct cost that eats into your profit margins.

Longer Cycle Times: Inefficient processes keep claims open longer. That means higher administrative costs and more capital tied up in reserves that could be used elsewhere.

Higher Compliance Risk: Messy documentation and inconsistent decisions create a poor audit trail, leaving you exposed to potential fines and regulatory penalties.

Lost Customer Trust: A slow, confusing claims experience is one of the fastest ways to lose a customer for good, hitting your retention numbers and profitability hard.

By shifting to an integrated enterprise claims management solution, you’re not just fixing operational problems. You’re turning a reactive cost center into a proactive, strategic part of your business.

The Technology Stack Driving Modern Claims

A high-performing enterprise claims management system is so much more than a digital filing cabinet. It's an integrated technology stack where each layer builds on the last, transforming a flood of raw, unstructured data into a clear, actionable strategy for every single claim. This system isn’t just about storing information; it’s about making that information intelligent.

Think of it like an expert crew working in perfect sync. Each tool in the stack has a specific job, from grabbing documents at the start to deep analysis and final reporting. Together, they create a powerful engine that drives efficiency, accuracy, and consistency across your whole claims operation.

Let's break down the core components that make up this modern technological backbone.

The Foundation: A Centralized Intake Platform

Everything starts with a centralized intake platform. This is the single, unified gateway for all incoming claim documents and data. It gets rid of the chaos of juggling multiple intake channels—email inboxes, client portals, physical mail—which is a recipe for lost files and critical delays.

This platform is the digital command center. It automatically ingests, organizes, and consolidates every piece of information into one workspace for each claim. By creating one reliable source of truth from the very beginning, you lay a clean foundation for everything that follows. That first step alone can dramatically cut the administrative grind for your team.

The Brain: An AI-Powered Evidence Refinery

Once all the documents are in one place, the AI-powered evidence refinery takes over. This is where the real magic happens. Unlike generic AI, this component uses domain-trained algorithms built specifically to understand the dense, complex language of legal and insurance documents. It reads, interprets, and categorizes every file with expert-level precision.

This AI refinery can:

Identify and Tag Key Documents: It instantly spots the difference between medical records, police reports, property assessments, and witness statements.

Extract Critical Data Points: It pulls out names, dates, policy numbers, and injury details, turning messy text into clean, structured data.

Organize Evidence Intelligently: It automatically sorts files into logical folders, so adjusters can find exactly what they need in seconds, not hours.

This process shrinks painstaking manual triage that used to take hours into just a few minutes. That frees up your people to focus on high-value analysis and decision-making.

The core function of an evidence refinery is to structure the unstructured. By transforming a chaotic pile of documents into an organized, queryable dataset, it enables the system to perform sophisticated analysis and deliver actionable insights.

The Co-Pilot: A Risk Intelligence Engine

With the evidence refined and structured, the risk intelligence engine steps in to provide a crucial first-pass assessment. Think of this tool as an expert co-pilot for your adjusters. It gives them an immediate, data-driven perspective on each claim's potential complexity, severity, and overall risk profile. It's a vital layer in effective enterprise claims management.

A key output is often a claim confidence score, which instantly flags cases that need a senior review or a deeper dive. On top of that, its automated gap detection is invaluable. It systematically scans the file for missing documents or inconsistencies between different pieces of evidence—like a mismatch between a claimant's statement and an official report. This lets your team get ahead of potential issues before they spiral.

The Accelerator: Automated Drafting and Workflow Tools

The final layer in the stack includes tools that get you to resolution faster. Automated drafting tools use the refined evidence to help generate routine communications, settlement offers, or denial letters, all while ensuring consistency and compliance with your company's standards. These tools don't replace adjusters; they empower them to work faster and with more accuracy.

The property and casualty insurance sector is embracing this kind of automation at a rapid pace. By 2025, technology is expected to handle over 50% of routine processing tasks like data collection and communication, allowing human adjusters to concentrate on the most complex and high-stakes cases. This shift is a massive help for carriers and TPAs trying to manage huge claim volumes effectively.

By integrating these powerful components, a modern tech stack turns claims management from a reactive, costly process into a real strategic advantage. You can explore more about the top benefits of artificial intelligence in claims processing to see how this technology delivers tangible returns.

A Roadmap for System Implementation

Bringing a new enterprise claims management system on board is a full-blown business transformation, not just another IT project. Success comes down to a smart, phased approach that ties the technology directly to your operational goals. Think of it less like a sprint and more like a carefully planned expedition—each stage builds on the last, helping you reach your destination without any expensive detours.

A solid roadmap takes the complexity out of the journey, breaking a huge undertaking into manageable steps. This guide lays out a clear path for risk, compliance, and operations leaders, from the initial planning all the way to long-term optimization.

Phase 1: Discovery and Goal Setting

Before you even think about looking at vendors, you need to define what success actually looks like for your organization. This first phase is all about deep introspection. Where are the biggest headaches right now? What are the most frustrating bottlenecks in your current claims workflow?

The goal here is to turn those pain points into concrete, measurable objectives. Vague wishes like “improving efficiency” just won’t cut it. You need to zero in on specific Key Performance Indicators (KPIs).

Cut claim cycle time by 20% within the first year.

Lower the administrative cost per claim by 15% by automating manual triage.

Boost fraud detection rates by 10% using proactive AI analysis.

Hit a 95% compliance score on internal audits with better, more accessible documentation.

This data-driven foundation will steer every decision you make from here on out, making sure the final system directly solves your most critical business challenges.

Moving forward without clear, quantifiable goals is like building a house without a blueprint. You might end up with something standing, but it probably won't be the functional, stable structure your business needs to thrive.

Phase 2: Vendor Selection

Once your goals are crystal clear, you can start shopping for a vendor. This isn't just about ticking boxes on a feature list. It's about finding a real partner who gets the unique complexities of the insurance and legal worlds and is equipped to support your long-term vision.

Here are the key qualifications to look for:

Domain Expertise: Does the vendor live and breathe property and casualty claims? Generic, one-size-fits-all platforms often miss the nuance required to handle complex legal and insurance data.

Enterprise-Grade Security: Look for non-negotiables like SOC 2 Type II certification and HIPAA readiness. This is your proof that the vendor meets tough standards for data security, availability, and confidentiality.

Proven Integration Capabilities: The platform has to play nicely with your existing systems. Ask for specific examples of how they connect with core admin platforms or legal billing software using APIs.

Scalability: Can the system grow with you? You need to be sure the architecture can handle a rising tide of claims without slowing down.

Phase 3: Integration and User Training

After you've chosen your partner, the focus shifts to making it all work. A classic mistake is to treat this as a purely technical task. The human element is just as crucial. A successful launch depends on integrating the system and training your people in parallel.

The technical integration should be a close collaboration with your vendor, ensuring clean data flows between the new platform and your existing tech. At the same time, build out a solid training program. Don't just rely on a single webinar—offer hands-on workshops, create quick-reference guides, and empower a few internal "champions" to help their colleagues. User adoption is the real measure of success, so invest in it.

This level of planning is more critical than ever as enterprise risks grow. Take the rising frequency of warranty and indemnity (W&I) claims in M&A deals, for instance. In North America alone, clients recovered over $1.4 billion from these claims, a number that highlights the massive financial stakes involved. You can dive deeper into these trends in Aon's Global Claims Study.

Phase 4: Continuous Optimization

Going live isn't the finish line; it's the starting line. The final phase is all about continuous optimization. Circle back to your original KPIs regularly to see what kind of impact the system is having. Are you hitting your targets for reduced cycle times and cost savings?

Use the platform’s own analytics to spot new opportunities for improvement. Get feedback from your team to understand what’s working and where the friction points are. The best enterprise claims management systems aren’t set in stone—they evolve with your business, helping you adapt to new challenges and find new ways to be more effective.

Measuring Success and Proving ROI

Putting a modern enterprise claims management platform in place is more than an operational upgrade—it's a strategic investment. To justify the cost and effort, you have to prove its worth with cold, hard numbers. That means looking past vague goals like “improving efficiency” and zeroing in on the tangible business outcomes that directly feed your bottom line.

The trick is to connect the platform’s features to specific Key Performance Indicators (KPIs). These metrics are the language of business value. They translate faster workflows and smarter decisions into measurable financial gains. By tracking the right data, you can build a powerful business case that shows a clear return on investment (ROI).

Key Performance Indicators to Track

Your dashboard for success should be built around a core set of metrics reflecting both operational health and financial performance. These KPIs give you the evidence you need to show how technology is driving real-world improvements.

Start by tracking these essential indicators:

Claim Cycle Time: This measures the average time from the First Notice of Loss (FNOL) all the way to the final claim settlement. A significant drop here proves the system is crushing bottlenecks and speeding up resolutions.

Cost Per Claim: This calculates the total administrative and operational overhead tied to handling a single claim. Automation in areas like document triage and data entry should drive this number down—a lot.

Adjuster Productivity: Don't just count closed claims. Track how much time adjusters spend on high-value analysis versus low-value admin tasks. The goal is to free them up for strategic decision-making.

Fraud Detection Rate: This KPI measures the percentage of fraudulent claims you successfully catch before payout. Advanced AI can boost this rate, directly preventing financial losses.

Proving ROI is about telling a data-driven story. It’s showing how a 25% reduction in cycle time directly translates to lower operational costs, improved customer satisfaction, and a stronger competitive position in the market.

Building the Business Case for ROI

Once you're tracking these KPIs, you can calculate a clear ROI. The formula itself is simple: compare the net profit or savings the platform generates against its total cost. The magic is in actually quantifying those gains.

For example, if automating document collection helps your team process 500 more claims per month without adding headcount, you can calculate the direct labor savings. If faster resolutions mean you can release $2 million from claim reserves a month earlier, that’s a massive gain in capital efficiency.

These data points completely change the conversation. Your investment in enterprise claims management is no longer just a line item on an expense report. It becomes a documented engine for profitability, risk reduction, and sustainable growth, proving its strategic value to any executive or stakeholder.

Got Questions? We've Got Answers

Thinking about making the switch? Here are some straightforward answers to the questions we hear most often about moving to a modern enterprise claims management system.

What’s the First Step to Improve Our Claims Process?

The best place to start is by looking at your current workflow to find the single biggest bottleneck. For most carriers, TPAs, and law firms, that weak link is the manual intake and triage of new claim documents.

Bringing in a centralized intake platform that automatically sorts and organizes files from every source—email, portals, you name it—delivers an immediate win. This first step creates a solid foundation you can build on later with more automation.

A classic mistake is trying to boil the ocean. If you focus on mastering that "first mile" of data collection, you'll score a quick victory that proves the value and builds momentum for the whole project.

How Does AI in Claims Management Keep Our Data Secure?

The top-tier AI platforms are built from the ground up with enterprise-grade security in mind. You'll want to look for solutions with certifications like SOC 2 and that are HIPAA-ready. Honestly, those are non-negotiable when you're handling sensitive claim information.

These systems use really strict access controls and protocols, creating a consistent, fully auditable trail for every single action taken on a claim. This gives your risk and compliance leaders the complete oversight they need to feel confident and in control.

Can a New System Even Work with Our Existing Software?

Absolutely. Modern claims platforms are designed to play well with others. They use APIs (Application Programming Interfaces) to connect with the systems you already rely on, whether it's a core admin platform or your legal billing software.

This ensures all your data flows smoothly across your entire tech stack, so you don't end up creating new information silos that just cause more headaches down the road.

Ready to turn your claims operation from a cost center into a real strategic advantage? See how Wamy uses AI to transform raw claim data into confident, audit-ready decisions. Learn more about Wamy's AI claims intelligence platform.

© 2025 Wamy. All rights reserved.