A Guide to Integrated Case Management Software in P&C Claims

Jan 17, 2026

Discover how integrated case management software transforms P&C claims. Learn core features, ROI, and implementation strategies for maximum efficiency.

Think about the last time you tried to solve a complex puzzle, but every single piece was hidden in a different room. That’s the daily reality for most P&C claims adjusters. They’re constantly hunting for information—policy details in one system, vendor reports in another, and critical communications buried in endless email chains. It's a recipe for delays and mistakes.

Integrated case management software cuts through that chaos. It acts as a central command center, pulling all those scattered puzzle pieces—data, documents, and conversations—into a single, unified workspace. This isn't just about going digital; it's about transforming a fragmented process into a smart, efficient, and transparent operation.

Unlocking Efficiency in P&C Claims

The real magic of an integrated platform is how it connects previously isolated functions. Instead of juggling spreadsheets and chasing email threads, teams can manage the entire claims lifecycle from first notice of loss to final settlement, all within one system. This brings all stakeholders onto the same page with access to the same real-time information, creating a single source of truth for every claim.

The shift from manual coordination to automated workflows delivers immediate, tangible benefits.

From Disconnected Data to Unified Workflows

An integrated platform is designed to consolidate the core functions that keep a claim moving forward. What does that actually look like in practice?

Centralized Documentation: Every file, from the initial loss report to the final settlement agreement, is stored and organized in one secure, easily searchable place. No more hunting for attachments.

Streamlined Communication: Internal notes, policyholder messages, and vendor emails are all logged directly within the case file. This creates a complete, chronological history of every conversation.

Automated Task Management: The system can be configured to automatically assign tasks, send reminders, and escalate issues based on your team's rules, ensuring nothing ever falls through the cracks.

Holistic Case View: Adjusters get a true 360-degree view of the claim—policy info, claim history, associated contacts—all from a single dashboard.

By bringing these functions together, the software eliminates the administrative friction that bogs down resolutions. It moves an insurer from a state of organized chaos to one of structured efficiency, where data drives decisions and automation handles the repetitive grunt work.

The Foundational Value of Integration

Ultimately, this technology is about much more than just digitizing paperwork. It’s about building a more intelligent and responsive claims process from the ground up.

When information flows freely from intake and investigation through to evaluation and settlement, the entire operation becomes more powerful. Adjusters are freed up to focus on what they do best: critical thinking, complex problem-solving, and delivering exceptional customer service. This is the fundamental shift that leads to faster resolutions, lower operational costs, and a vastly improved policyholder experience. Adopting an integrated platform is a strategic move toward building a more agile and competitive claims organization.

Exploring the Core Components of an Integrated Claims Platform

So, what really separates a powerful integrated claims platform from a glorified digital filing cabinet? The magic is in its core components—the interconnected engines that work together to bring speed and clarity to every claim. If you understand these parts, you can spot a solution that doesn't just store information, but actively helps you resolve claims faster.

Think of it like the dashboard in a modern car. It doesn't just show your speed. It gives you a complete, real-time picture of everything that matters: fuel, engine temp, tire pressure, and navigation, all in one glance. A truly integrated platform does the same thing for a claim, giving adjusters that 360-degree view they need to make smarter decisions.

The Unified Dashboard: A Single Source of Truth

The heart of any integrated platform is the unified dashboard. This is the command center where an adjuster starts their day and wraps it up. It pulls every piece of relevant information into one intuitive screen, ending the frustrating ritual of toggling between systems, sifting through emails, and digging through shared drives.

A well-designed dashboard isn't just a list of files; it's a dynamic workspace. It gives you an at-a-glance view of a claim's entire lifecycle, surfacing critical data points and upcoming deadlines. For a claims manager, it might instantly show the team's caseload, flag overdue tasks, or highlight high-risk claims that need a second look.

Automated Workflow Engines: The Brains of the Operation

If the dashboard is the heart, the automated workflow engine is the brain. This is where static, manual processes are transformed into smart, automated sequences. It’s the "if-then" logic that makes sure the right task gets to the right person at the right time—no manual hand-offs required.

Think about the first notice of loss. An automated workflow can instantly read an incoming claim, categorize it by type, and assign it to an available adjuster with the right expertise. That kind of intelligent routing drives consistency and makes sure your business rules are followed every single time.

But these workflows go far beyond simple assignments. They can manage complex, multi-step processes without breaking a sweat. For example:

Fraud Detection: A workflow can be set up to automatically flag claims with suspicious patterns—like a high-value claim filed right after a policy change—and send it directly to your SIU team for review.

Approval Chains: When a settlement offer hits a certain dollar amount, the system can automatically route it up the approval chain, from the adjuster to their manager and then to the director, documenting every sign-off.

Task Dependencies: The system can enforce critical dependencies, like ensuring a payment isn't issued until a signed release form has been received and verified in the system.

By automating these actions, you free up your team from administrative busywork so they can focus on the judgment calls that really matter.

Centralized Document and Communication Hubs

One of the biggest drags on efficiency is the nightmare of version control. Multiple copies of a document saved in different places just creates confusion and risk. An integrated platform solves this with a centralized document hub, where every file related to a claim is stored, versioned, and accessible to anyone with the right permissions.

A centralized hub ensures that everyone—from the adjuster to legal counsel to the policyholder—is working from the same set of documents. This eliminates conflicting information and creates a clear, audit-ready record of the claim's history.

This central hub approach extends to communications, too. Every email, internal note, and message is logged right inside the case file, creating a complete, chronological record. An adjuster can get up to speed on a colleague's file in minutes, without having to piece together the story from scattered email threads. The need for smarter intake is growing, and you can learn more by checking out our guide on AI intake forms for P&C claims management.

The demand for these tightly connected systems is fueling major market growth. In fact, the global case management software market, valued at USD 7.4 billion in 2024, is set to grow at a 9.6% CAGR through 2034. A huge part of that growth is driven by organizations adopting AI for intelligent routing and automation, which requires robust integration and support services.

How Integrated Software Delivers Tangible Benefits

Adopting new technology isn’t just about adding features; it’s about driving real business outcomes. For P&C insurers, integrated case management software isn't just another tool—it's the engine that converts better processes into measurable gains. The value it creates is clear across three core areas that directly impact your operations and, ultimately, your bottom line.

These benefits go far beyond simple conveniences. They fundamentally change how claims are handled from the first notice of loss all the way to final settlement. By replacing fragmented, chaotic workflows with one unified system, insurers unlock a whole new level of performance.

Boosting Operational Efficiency

The first and most immediate impact you'll see is a dramatic boost in operational efficiency. This kind of software attacks the administrative drag that bogs down the claims process, automating the repetitive tasks that eat up time and freeing up your most valuable asset: your adjusters.

Think about the sheer manual effort in traditional claims handling. Hours are wasted just searching for documents, chasing approvals, and punching the same data into multiple systems. Automation wipes that friction away.

For instance, an automated workflow can instantly route a new claim to the right adjuster, schedule the initial follow-ups, and generate the necessary letters without a single human touch. This one change can slash the time a claim sits idle, turning average cycle times from weeks into mere days. To find more strategies like this, check out our guide on the 10 P&C claims case management best practices for 2025.

To really grasp the difference, it helps to see the old way of doing things side-by-side with the new.

From Manual Processes to Integrated Management: A Comparative Analysis

This table breaks down the shift from frustrating, manual P&C claims handling to the streamlined approach offered by integrated case management software. It highlights just how profound the improvements are across key operational areas.

Operational Area | Traditional Process (The Challenge) | Integrated Software (The Solution) |

|---|---|---|

Claim Intake | Manual data entry from multiple sources (email, phone, fax), leading to delays and errors. | Automated intake from all channels into a single, unified case file. |

Document Management | Disorganized files across email inboxes, network drives, and physical folders. Document retrieval is slow and unreliable. | Centralized, cloud-based repository where every document is automatically tagged, indexed, and instantly searchable. |

Task & Workflow | Relies on manual checklists, spreadsheets, and memory. Tasks are easily missed, and bottlenecks are hard to spot. | Automated workflows that assign tasks, send reminders, and escalate issues based on predefined rules. |

Communication | Fragmented communication trails (emails, phone notes) that are difficult to track and reconstruct for audits. | All communications are logged directly within the case file, creating a complete, time-stamped record. |

Reporting & Analytics | Time-consuming manual report creation using spreadsheets. Insights are often outdated by the time they are compiled. | Real-time dashboards and automated reporting that provide instant visibility into KPIs, workloads, and performance. |

This comparison makes it clear: integrated software doesn't just make the old process faster; it introduces a fundamentally better, more reliable way to manage claims.

Delivering a Superior Customer Experience

Today’s policyholders have high expectations. They want transparency, and they want speed. A slow, confusing, and opaque claims process is one of the quickest ways to lose a customer for good. Integrated case management software tackles this problem head-on by creating a more connected and responsive experience.

When all claim information lives in one place, adjusters can give accurate, real-time updates without having to dig through different systems. Automated notifications can keep policyholders in the loop at key moments, like when a payment is sent or a crucial document is received.

This kind of proactive communication builds trust and dials down the anxiety that naturally comes with a claim. Faster resolutions mean policyholders get back on their feet sooner, turning a stressful event into a positive touchpoint that builds loyalty and keeps them coming back.

Strengthening Compliance and Audit Readiness

In an industry as heavily regulated as insurance, compliance isn't optional. Trying to manually track every action, decision, and communication for a claim is not just inefficient—it’s a huge risk. It opens the door for human error and turns audit preparation into a nightmare.

An integrated platform solves this by building an impeccable, time-stamped digital trail for every single action.

Every note, document upload, approval, and communication is automatically logged within the case file. This creates a single, immutable record that serves as the definitive source of truth, making the entire process audit-ready from day one.

This rigorous documentation makes regulatory reporting simple and minimizes risk. If a claim is ever challenged, you can instantly pull up a complete history, proving you followed both internal policies and external regulations with total confidence. This structured approach isn't unique to insurance; the telecom and IT sectors made integrated software essential for managing massive volumes of customer interactions. In 2023, this segment led the global market as companies grew and needed to manage complaints and service requests efficiently, turning operational chaos into a competitive edge. You can discover more insights about these market trends on futuremarketinsights.com.

Choosing the Right Software for Your Organization

Picking the right integrated case management software is one of those strategic decisions that will define your operations for years to come. It’s not about finding the platform with the longest feature list; it’s about finding a true partner that gets your business, scales with your ambition, and actually makes your team’s job easier. Get it wrong, and you’re stuck with a system that creates more friction than it solves, frustrating your best people and wasting money.

This isn’t a decision you can make from a sales deck. It requires a structured approach and some tough, practical questions to see if a solution can really perform under pressure in your environment.

Evaluating Scalability and Future-Readiness

The first litmus test is scalability. The software you choose today has to handle your claims volume five years from now, not just on a quiet Tuesday. A platform that crumbles during a catastrophe or as your business grows isn't an asset; it's a liability.

Ask the hard questions:

Can the system absorb a massive, sudden spike in claims without slowing to a crawl?

What’s the vendor’s roadmap for architecture and updates? Are they building for the future?

Is the pricing model predictable as we scale, or are there hidden costs waiting to bite us?

A genuinely scalable platform should feel like moving into a building with plenty of extra room, not one where you're already hitting maximum capacity on day one.

This forward-thinking approach is critical. The global case management software market was valued at USD 8.41 billion in 2024 and is on track to hit USD 26.82 billion by 2032. This isn’t just numbers on a page; it’s proof of a massive industry shift toward smarter, unified solutions. You need a platform built for where the industry is going. You can see the full market projections from 360iResearch for a deeper dive.

Assessing Integration Capabilities

Next, you have to get serious about integration capabilities. An "integrated" platform that can’t talk to your other core systems is a contradiction in terms. The last thing anyone needs is another data silo that forces adjusters back into the soul-crushing work of manual double-entry.

Your evaluation needs to confirm that the software connects cleanly with your existing infrastructure—your policy admin system, billing platforms, and any third-party data sources you depend on. Look for a robust API (Application Programming Interface) and pre-built connectors. That’s the mark of a well-designed, flexible system that can maintain a single source of truth across your entire tech stack.

Prioritizing the User Experience

Here’s a hard truth: the most powerful software on the planet is useless if your adjusters hate using it. A clunky, confusing, or slow interface will kill adoption every time. User experience (UX) isn't a "nice-to-have"; it’s a non-negotiable requirement. If the platform feels like a fight, your team will find workarounds, and you’ll be right back to managing claims in spreadsheets.

Here’s what a great UX looks like in practice:

Intuitive Navigation: The layout should be clean and logical. Your adjusters should be able to find what they need without a week-long training course.

Configurable Dashboards: Every user should be able to tailor their workspace to see the information that matters most to their role.

Responsive Performance: The system has to be fast. Lagging screens and slow load times are productivity killers and a massive source of frustration.

A platform with a thoughtful user experience empowers your team by getting out of their way. Always, always insist on a hands-on demo or a pilot program. Let your actual users put the system through its paces in real-world scenarios before you sign on the dotted line.

A Strategic Roadmap for Successful Implementation

Turning a powerful software purchase into a genuine operational advantage requires more than just flipping a switch—it demands a thoughtful plan. A successful implementation is where technology, people, and processes meet to ensure a smooth rollout and, most importantly, high user adoption. The goal is to make your technology vision an operational reality, not just another piece of software gathering dust.

The best way to get there is a phased approach. Forget the risky, big-bang launch. Start with a targeted pilot program. This lets you test the integrated case management software with a smaller, focused team, iron out any kinks, and score some early wins that build momentum and excitement across the organization.

Securing Stakeholder Buy-In From Day One

Your roadmap's first step has nothing to do with technology and everything to do with people. You have to get genuine buy-in from every level of the organization—from executive sponsors right down to the claims adjusters who will be in the system every single day. This isn’t about getting a sign-off; it’s about making them active partners in the change.

To get there, you need to communicate the why behind the new system. Don't just list features. Explain how this software will cut down on tedious admin work, speed up resolutions, and ultimately help them deliver better outcomes for policyholders. When your team sees the platform as a tool to make their jobs easier and more effective, adoption becomes a natural next step.

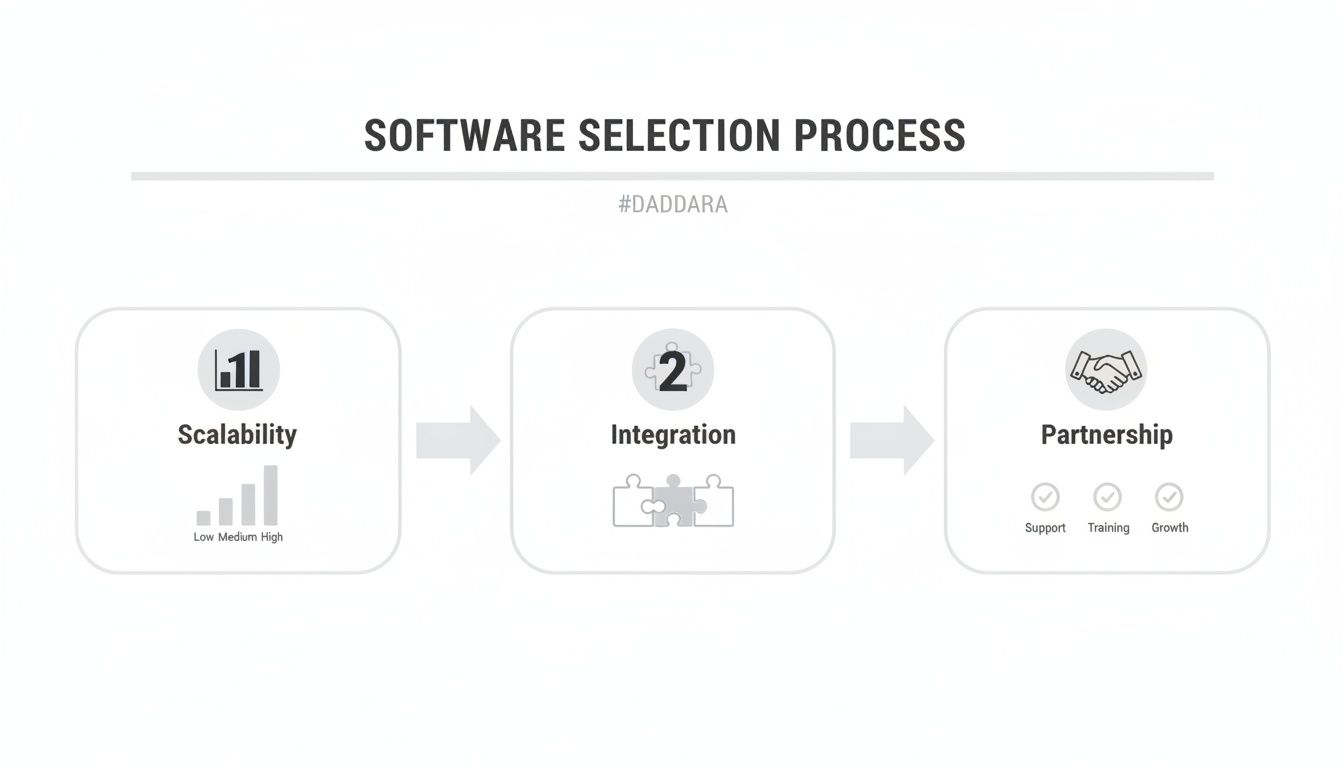

The graphic below highlights the key pillars of selecting the right software, which is a foundational part of this entire process.

As you can see, success starts with choosing a solution that can grow with you, integrate with your other tools, and comes from a vendor who is committed to being a true partner.

Developing Comprehensive Training and Data Migration

With your stakeholders on board, the next move is all about practical execution. This means running two critical tracks in parallel: training your people and migrating your data. Generic, one-size-fits-all training is a recipe for failure. Instead, you need to develop comprehensive training modules tailored to different roles.

Claims Adjusters: Need hands-on training that digs into daily workflows, document management, and communication tools.

Managers and Supervisors: Need to master the reporting dashboards, workload balancing features, and performance analytics.

IT and Administrators: Require deep-dive knowledge of system configuration, user permissions, and all the integration points.

At the same time, you need to execute a meticulous data migration plan. Clean, accurate data is the lifeblood of your new system. You'll want to work closely with your vendor to map fields, scrub existing records, and run several test migrations to ensure a seamless transition without disrupting your day-to-day operations.

The real measure of an implementation's success is how quickly and effectively the team can actually use the new system. A well-planned training and data migration strategy is the bridge that gets them there.

Defining Your Success Metrics Upfront

Finally, you can't hit a target you haven't defined. Before you even think about going live, you must establish clear, measurable key performance indicators (KPIs) to track your success. Knowing what you want to achieve is the only way you'll know if you've actually achieved it.

These metrics should be specific and tied to real business outcomes. Are you shooting for a 25% reduction in claim processing time? A 10-point jump in your policyholder Net Promoter Score (NPS)? Or maybe a 15% decrease in administrative overhead? By defining these goals upfront, you create a clear benchmark to measure your return on investment and prove the strategic value of your new integrated case management software.

Measuring ROI and Preparing for Future Trends

Any investment in new technology has to prove its worth, and with integrated case management software, that proof is refreshingly easy to find. Figuring out your Return on Investment (ROI) isn't just about crunching numbers; it's about tracking both the hard data and the softer, but equally critical, improvements across your claims operation. This process doesn't just justify the upfront cost—it builds the business case for what comes next.

To really see the impact, you have to start with the metrics you can measure. These are the tangible, data-driven results that directly hit your bottom line. By getting a clear baseline before you flip the switch, the performance gains will be impossible to miss.

Calculating the Tangible Returns

The most convincing ROI metrics are always the ones tied directly to efficiency and cost savings. Here are the key numbers to watch:

Reduced Cost-Per-Claim: When you automate the tedious administrative work and get your workflows humming, adjusters can manage more claims without breaking a sweat. This directly drives down the overhead tied to every single claim.

Faster Claim Cycle Times: Automation just makes everything quicker, from the moment a claim comes in to the final settlement. Track the average time from the first notice of loss to final payment, and you'll see a dramatic drop.

Lower Litigation Expenses: Having a perfectly organized, audit-ready record for every claim puts you in a much stronger position when disputes arise. You’ll often see both the frequency and the cost of litigation go down.

But don't stop at the hard numbers. The less tangible benefits are just as important. Things like improved employee satisfaction scores and higher policyholder Net Promoter Scores (NPS) are strong signs of a healthier, more resilient operation.

A platform that eliminates manual drudgery doesn’t just make your team faster; it boosts morale. That leads to lower employee turnover, which is a huge—if less direct—cost saving.

Staying Ahead with Future-Ready Technology

An integrated platform is more than just a fix for today’s problems; it’s the foundation for tomorrow's breakthroughs. The future of claims management is being shaped by intelligent technologies, and they all rely on the centralized data and automated workflows this software provides.

Artificial intelligence (AI) and machine learning are leading the charge, moving past simple task automation and into the realm of predictive analytics. These systems can sift through mountains of data to spot the subtle red flags of fraud long before a claim escalates, saving you a fortune. As these tools get smarter, it’s obvious that the future of efficiency will involve automating routine legal and P&C claim workflows on an even deeper level.

At the same time, the boom in low-code and no-code platforms is making insurers more nimble. These tools give claims departments the power to tweak and build their own workflows without waiting on a long IT queue. This means you can react instantly to market shifts or new regulations. By adopting integrated case management software now, you're not just solving current headaches—you’re building an innovative, customer-first claims operation that’s ready for whatever comes next.

Frequently Asked Questions

How Long Does It Typically Take to Implement an Integrated Case Management System?

That’s the million-dollar question, isn't it? The timeline really depends on the complexity of your organization, how much customization you need, and the scope of your data migration. For a typical mid-sized P&C insurer, you're generally looking at a 4 to 9 month window from kickoff to go-live.

We always recommend a phased rollout that starts with a smaller pilot program. This gives your team a chance to learn the ropes and iron out any kinks in a controlled environment. It’s the single best way to ensure a smoother, enterprise-wide deployment and get your adjusters on board faster.

Can This Software Integrate with Our Existing Legacy Systems?

Absolutely. A key strength of any modern integrated case management software is its ability to play nicely with other systems. Most of the leading platforms come equipped with robust APIs (Application Programming Interfaces) and a library of pre-built connectors for the usual suspects—policy admin, billing, and CRM platforms.

When you're vetting vendors, make this a top-line discussion. Lay out your entire tech stack for them. The goal is to ensure they can deliver a seamless connection, so you aren't creating new data silos or forcing your team into double-data entry.

What Is the Biggest Challenge Companies Face When Adopting This Software?

Honestly, the tech is rarely the hardest part. The real challenge is almost always managing the human side of the change. Your adjusters might have been using the same—albeit clunky—workflows for years, and old habits die hard.

The biggest challenge is often not the technology itself, but managing organizational change. Employees may be resistant to new workflows after years of using established, albeit inefficient, processes.

Success boils down to strong leadership, clear communication about the why, and great, role-specific training. You have to show them how this new system makes their lives easier by cutting down manual work and helping them close claims faster. Getting genuine buy-in from your claims adjusters and managers from day one is the key to seeing a real return on your investment.

Turn your raw P&C claims data into confident, audit-ready decisions with Wamy. Our AI claims intelligence platform helps you collect documents up to 77% faster and resolve claims up to four times faster. Discover how Wamy can transform your claims operations.

© 2025 Wamy. All rights reserved.